Fast Payments, Slow Risk Thinking: The Cybersecurity Wake-Up Call for Financial Infrastructure

The Illusion of Speed in a World of Fragile Trust

Fast Payment Systems (FPS) have become the arteries of today’s digital economy. In Hong Kong and across Asia, FPS underpins everything from retail payments and payroll to cross-border settlements and public service disbursements. The expectation is clear: instant, always-on, and frictionless.

But while the rails have been optimized for speed, the underlying systems remain dangerously underprepared for the velocity and volume of cyber threats they now attract.

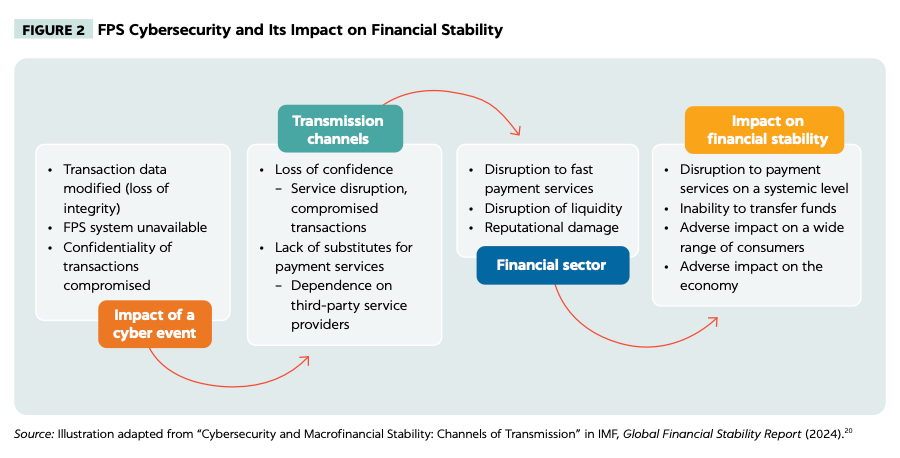

According to the World Bank’s Cyber Risks in Fast Payment Systems (February 2025), the rapid expansion of FPS globally has significantly increased the financial sector’s exposure to cyber incidents—shifting cyber risk from a technical problem to a systemic risk with macro-financial implications.

Cyber threats are no longer confined to IT departments—they now sit squarely on the agendas of boards, regulators, and investors. For institutions operating in globally connected hubs like Hong Kong, resilience is no longer optional—it is the currency of trust.

This blog distills the World Bank’s findings and explains why Studio AM’s Compliance-as-a-Service (CaaS) model is helping financial institutions across APAC embed resilience, meet regulatory expectations, and stay ahead of evolving threats.

📖 Ref: World Bank Group (2025). CYBER RISKS IN FAST PAYMENT SYSTEMS

Cyber Threats Are No Longer Contained—They Are Now Contagious

The World Bank report highlights an alarming rise in FPS-targeted cyberattacks. In 2023, ransomware attacks in the financial sector increased by 64%, and distributed denial-of-service (DDoS) attacks reached unprecedented scale and sophistication. These attacks are no longer isolated operational issues—they are cross-market contagion risks.

A ransomware attack in December 2023, for example, brought down a cloud service provider supporting over 60 U.S. credit unions—demonstrating how third-party vulnerabilities can paralyze entire sectors.

Even central banks have been impacted. The Central Bank of Lesotho had to suspend parts of its operations due to a cyber incident in late 2023, and the Central Bank of Mexico experienced coordinated cyberattacks on its SPEI system in 2018.

In highly interconnected financial markets like Hong Kong, where FPS is deeply embedded in banking and fintech ecosystems, these types of events could trigger real-time liquidity crises, reputational fallout, and regulatory scrutiny—overnight.

FPS Was Built for Liquidity—Not Resilience

The report underscores that many FPS infrastructures were designed to optimize throughput, interoperability, and cost-efficiency, but not necessarily cyber resilience. As a result, they are increasingly targeted by cybercriminals exploiting architectural blind spots.

Common vulnerabilities include:

- Insecure APIs and third-party integrations

- Spoofed or altered QR codes and mobile app interfaces

- Weak data integrity controls that hinder transaction tracing

- Proxy hijacking and alias manipulation

The report also notes that the speed and anonymity of FPS make them particularly attractive for fraud, money laundering, and cyber-enabled crime. These risks are amplified in regions where FPS is the dominant payment channel and regulatory controls are uneven.

Resilience by Design: Global Benchmarks

Several jurisdictions are already embedding cyber resilience into the core architecture of their FPS ecosystems—offering valuable models for financial institutions in Hong Kong and across APAC.

🇧🇷 Brazil

Banco Central do Brasil operates Pix, a real-time payment platform with a 15-minute recovery time objective and zero-minute recovery point objective. Transactions are digitally signed and encrypted, and non-compliance with cybersecurity requirements has directly resulted in successful cyber incidents.

🇵🇱 Poland

The Express Elixir system is certified against the ECB’s Cyber Resilience Oversight Expectations for Financial Market Infrastructures and regularly conducts penetration tests and business continuity drills.

🇧🇭 Bahrain

Bahrain treats its FPS as critical national infrastructure, requiring 99.99% availability and full ISO 22301 certification for business continuity. In 2023, the Central Bank of Bahrain led a sector-wide cyber wargame simulation focused on FPS disruption.

These examples demonstrate how proactive governance, regular testing, and architectural reform can strengthen cyber resilience and maintain public trust.

Compliance Is the New Infrastructure

According to the World Bank’s Global Payment Systems Survey, 25% of jurisdictions lack a formal cyber risk framework for FPS, and many others rely on fragmented or outdated approaches. In many cases, payment systems are not even included in national cybersecurity strategies.

At Studio AM, we help our clients move beyond traditional compliance. Our Compliance-as-a-Service (CaaS) model enables financial institutions to:

- Integrate compliance into DevOps and system architecture

- Align with global frameworks like DORA, ISO/IEC 27001, PCI DSS, HKMA TM-E-1, and MAS TRM

- Automate control adjustments based on transaction type, user behavior, and risk signals

- Provide board-level reporting and visibility on cyber and operational risk

Our goal is to turn compliance into a strategic advantage—not just a regulatory burden.

Resilience Is the Ultimate Market Signal

The World Bank notes that institutions demonstrating recoverability, transparency, and strong incident response capabilities are more likely to win regulatory trust and market confidence.

That’s why leading FPS operators are investing in:

- Real-time incident disclosure

- Public transparency around cyber-attacks

- Advanced fraud detection powered by machine learning

These practices reflect a broader shift: resilience is now a reputational asset. Institutions that can detect, contain, and recover from cyber threats without systemic disruption will be rewarded—not just by regulators, but by clients, partners, and investors.

Final Word: Cyber Resilience Is the New Liquidity

In a real-time financial system, where funds move in seconds and platforms operate 24/7, resilience is no longer a back-office issue—it is a boardroom priority.

The institutions that will lead the next decade will not be those with the flashiest features or lowest latency. They will be those that have reimagined compliance as infrastructure, embedded resilience into system design, and operationalized threat intelligence across every layer of their business.

At Studio AM, we partner with forward-looking financial institutions across Hong Kong and APAC to:

- Build FPS-aligned cyber and compliance frameworks

- Implement real-time risk detection and incident response

- Align with global and local regulatory requirements

- Turn compliance into a competitive edge

If you’re modernizing your payment systems or scaling your digital finance operations, we can help you design for resilience—before disruption happens.

Because in today’s financial ecosystem, resilience is the new liquidity.