The Cyber Battleground of Finance: Why Cybersecurity is Now a Business War, Not Just an IT Concern

Introduction: The Compliance & Cybersecurity Tightrope in Open Banking

Canada’s Open Banking framework is set to redefine financial services by 2026, creating a seamless, consumer-driven financial ecosystem. With Fintechs Canada advocating for all

The Financial Industry is Under Siege—Are You Ready?

Imagine this: your company’s CFO appears on a video call, urgently instructing a multi-million-dollar wire transfer. The voice, the mannerisms, the facial expressions—it’s all unmistakably authentic. But minutes after executing the transaction, you realize the horrifying truth: your CFO was never on the call.

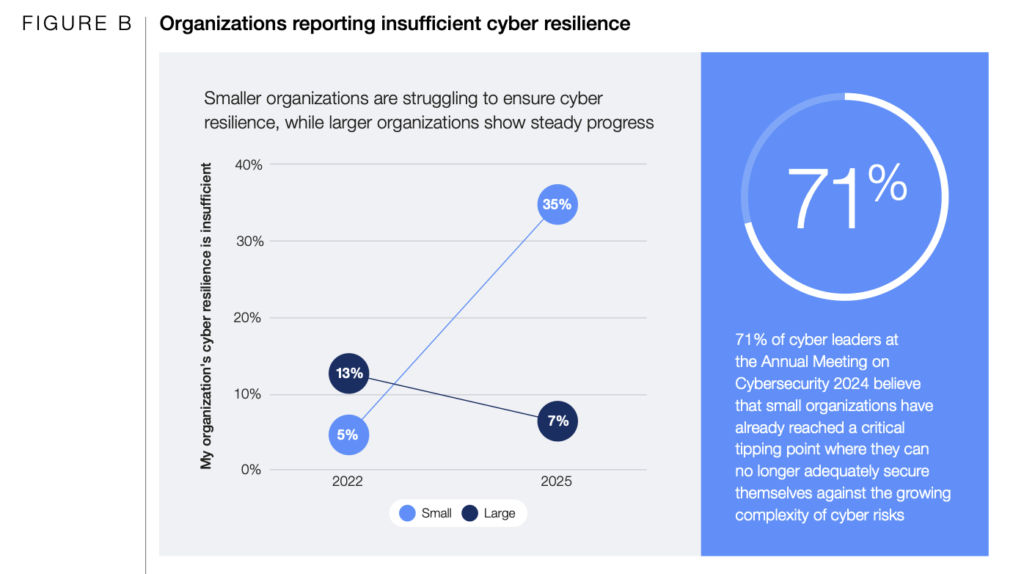

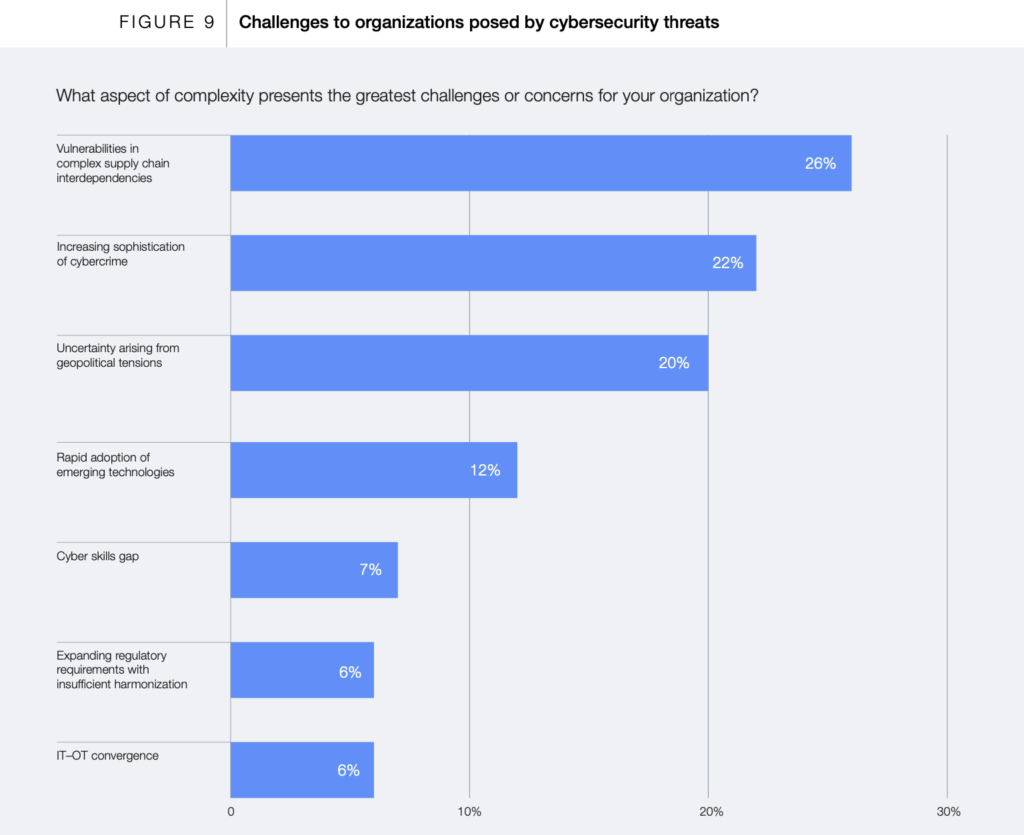

This isn’t a hypothetical scenario. It’s already happening. Financial institutions worldwide are now facing AI-powered deepfake fraud, supply chain cyberattacks, and regulatory chaos at an unprecedented scale. The Global Cybersecurity Outlook 2025 warns that we are entering an era where cyber risks are no longer just technical challenges—they are existential business threats that will determine which firms survive the next decade.

The financial sector has always been a prime target for cybercriminals, but something has fundamentally changed. Cyberattacks are no longer just about stealing data; they are about disrupting economies, manipulating markets, and weaponizing trust. Every financial institution—whether a massive investment bank, a fast-scaling fintech, or a compliance-driven regtech—is now a high-value target in a cyber war fueled by geopolitical tensions, AI-driven fraud, and fractured regulations.

This blog isn’t just another cybersecurity briefing. It’s a battle plan. If you’re a financial executive, compliance officer, or risk manager, you need to understand:

- Why compliance is becoming a regulatory minefield, and how failing to navigate it could cripple your business.

- How AI is both the greatest security weapon and the biggest cyber threat financial firms have ever faced.

- Why supply chain attacks are the silent killers of financial institutions, and why your biggest risk might not even be inside your own company.

- What’s coming next in cybersecurity—and how financial firms that prepare now will dominate the future, while those who don’t will struggle to survive.

The stakes have never been higher. Are you ready? Let’s dive in.

📖 Ref: World Economic Forum (2025), Global Cybersecurity Outlook 2025. https://reports.weforum.org/docs/WEF_Global_Cybersecurity_Outlook_2025.pdf

Compliance is Becoming a Cyber Minefield—Are You Walking Blindfolded?

For years, financial firms have been trapped in a regulatory arms race, scrambling to align with ever-changing cybersecurity mandates. But 2025 presents a new kind of challenge: compliance is no longer just about security—it’s a business risk that can directly impact operational stability and market competitiveness.

The NIS2 Directive in the EU, the SEC’s cybersecurity disclosure rules in the U.S., and the Digital Operational Resilience Act (DORA) are just a few examples of how regulators are tightening their grip on financial cybersecurity. Yet, rather than creating cohesion, these fragmented regulations are introducing conflicts, making it harder for multinational firms to maintain a unified security strategy.

This lack of harmonization is forcing financial institutions to devote excessive resources to regulatory compliance, often at the expense of real security improvements. The unintended consequence? Compliance fatigue. Many firms are stuck in a cycle of reactive patchwork solutions, trying to satisfy multiple regulators instead of developing a proactive, risk-based cybersecurity framework that truly protects their assets.

Leading financial firms are breaking out of this cycle by shifting their approach. Instead of treating compliance as a checklist, they are adopting universal cybersecurity principles that can flexibly adapt to any jurisdiction. This allows them to stay ahead of regulatory expectations without being bogged down by constantly changing rules.

Moreover, the rise of Compliance-as-a-Service (CaaS) providers is helping firms streamline their regulatory obligations. By outsourcing compliance management to experts, financial institutions can reduce administrative burdens, enhance security resilience, and ensure they remain audit-ready without disrupting core business operations.

The financial institutions that embrace compliance as a strategic advantage rather than a regulatory burden will be the ones that gain investor trust, regulatory goodwill, and long-term resilience in an increasingly volatile cyber environment.

AI is the Ultimate Double-Edged Sword—Will It Save or Destroy Financial Cybersecurity?

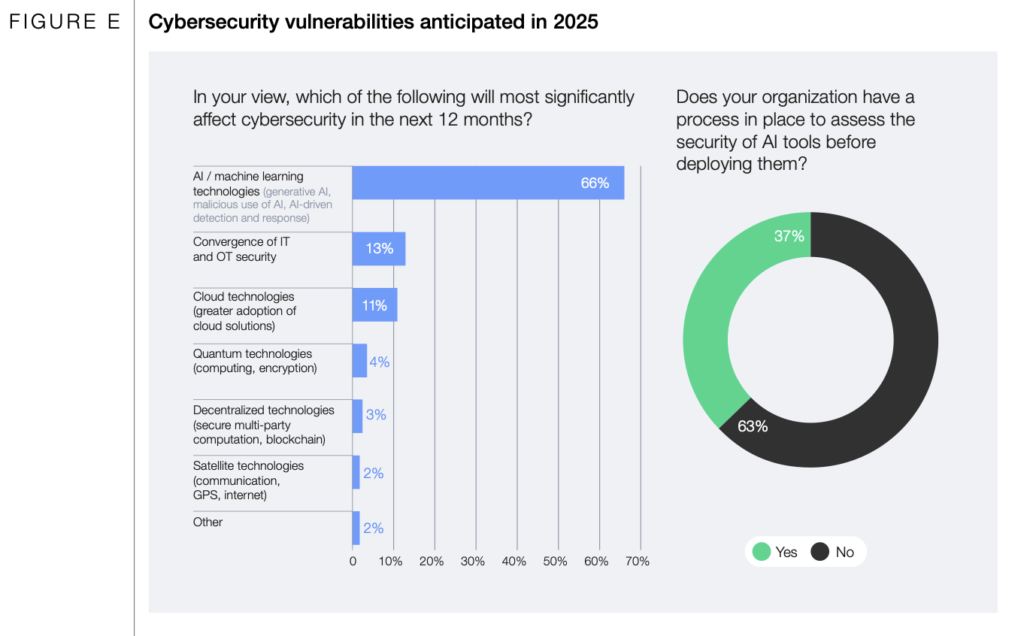

AI is revolutionizing financial cybersecurity, but it is also creating a new class of threats that many firms are unprepared for. The same AI-driven technologies that enhance fraud detection and risk analytics are being weaponized by cybercriminals to launch highly sophisticated attacks at scale.

One of the most alarming developments is the rise of AI-powered deepfake fraud. Cybercriminals are now using advanced AI models to create hyper-realistic audio, video, and text-based impersonations, tricking financial employees into approving fraudulent transactions. Traditional fraud prevention measures—such as voice verification and facial recognition—are becoming increasingly unreliable in the face of these AI-generated deceptions.

Beyond fraud, AI is also being leveraged to automate cyberattacks in ways that were previously impossible. Attackers are using AI to:

- Bypass traditional security defenses by generating phishing emails that are indistinguishable from legitimate communications.

- Scan financial networks for vulnerabilities at an unprecedented speed, identifying weak points before human security teams can detect them.

- Manipulate AI-driven decision-making systems, corrupting risk assessment models to trigger erroneous financial transactions or credit approvals.

To counteract these risks, financial firms must develop AI security governance frameworks that prioritize transparency, auditability, and continuous monitoring. AI systems cannot be treated as black-box solutions—they must be rigorously tested for vulnerabilities and adversarial manipulation to ensure they are not exploited by malicious actors.

Additionally, financial leadership must be directly involved in AI security discussions. AI-driven cybersecurity is no longer just a technical issue; it is a strategic imperative that requires oversight from CFOs, CROs, and compliance officers. Firms that fail to institutionalize AI security governance will find themselves vulnerable not only to cyberattacks but also to regulatory scrutiny as governments begin demanding greater accountability in AI-driven decision-making.

The Hidden Cyber Threat No One is Talking About: Financial Supply Chain Attacks

Financial institutions are deeply interconnected, relying on a vast ecosystem of third-party vendors, cloud providers, and payment processors. While these partnerships drive efficiency, they also introduce significant cybersecurity risks that many firms are failing to adequately address.

The Global Cybersecurity Outlook 2025 highlights how supply chain vulnerabilities are now among the most pressing threats in financial cybersecurity. A single breach at a critical vendor can trigger a ripple effect of disruptions across the entire financial ecosystem, as seen in the 2024 CrowdStrike outage, which temporarily crippled businesses worldwide.

To mitigate these risks, financial firms must move beyond outdated periodic vendor audits and adopt continuous third-party risk monitoring. Real-time security assessments, automated risk scoring, and contractual security obligations are becoming essential components of modern supply chain cybersecurity strategies.

Regulators are also taking notice. The EU’s Cyber Resilience Act and the U.S. Executive Order 14028 are introducing stricter security requirements for software providers and third-party vendors. Financial firms that proactively implement Software Bill of Materials (SBOM) tracking and enforce zero-trust security models will not only reduce their risk exposure but will also stay ahead of evolving regulatory demands.

The Future of Financial Cybersecurity—What’s Coming Next?

Based on the Global Cybersecurity Outlook 2025, we can predict several key developments that will reshape financial cybersecurity over the next 12-18 months:

- Cybersecurity will become a direct financial performance metric. Expect investors and rating agencies to start factoring cyber resilience into credit ratings and stock valuations.

- Cyber insurance will get harder (and more expensive) to obtain. Insurers will require higher security benchmarks before offering coverage, and firms with weak cybersecurity will be uninsurable.

- Regulators will enforce cybersecurity accountability at the executive level. Expect laws that hold CFOs, CROs, and board members personally liable for cybersecurity failures.

- AI-driven cybercrime will become the biggest financial fraud risk. Deepfake scams and AI-powered phishing will skyrocket in sophistication and frequency.

🎯 Final Thought: Cybersecurity is Now a Competitive Advantage, Not Just a Defense Strategy

The financial firms that win in 2025 won’t just comply with cybersecurity regulations—they’ll turn cybersecurity into a business advantage.

- A strong cybersecurity posture will attract investors, customers, and regulatory goodwill.

- Proactive cybersecurity leadership will prevent catastrophic financial losses.

- The ability to navigate regulatory fragmentation will set apart industry leaders from laggards.

At Studio AM, we specialize in turning compliance into a competitive edge. From navigating multi-jurisdictional regulations to building AI-secure financial ecosystems, our Compliance-as-a-Service (CaaS) solutions ensure that cybersecurity is not just a cost center, but a business enabler.

🚀 Ready to future-proof your financial organization’s cybersecurity strategy? Contact Studio AM today to stay ahead of the evolving cyber landscape.