The Future of Compliance: How GenA.I. is Reshaping Financial Services

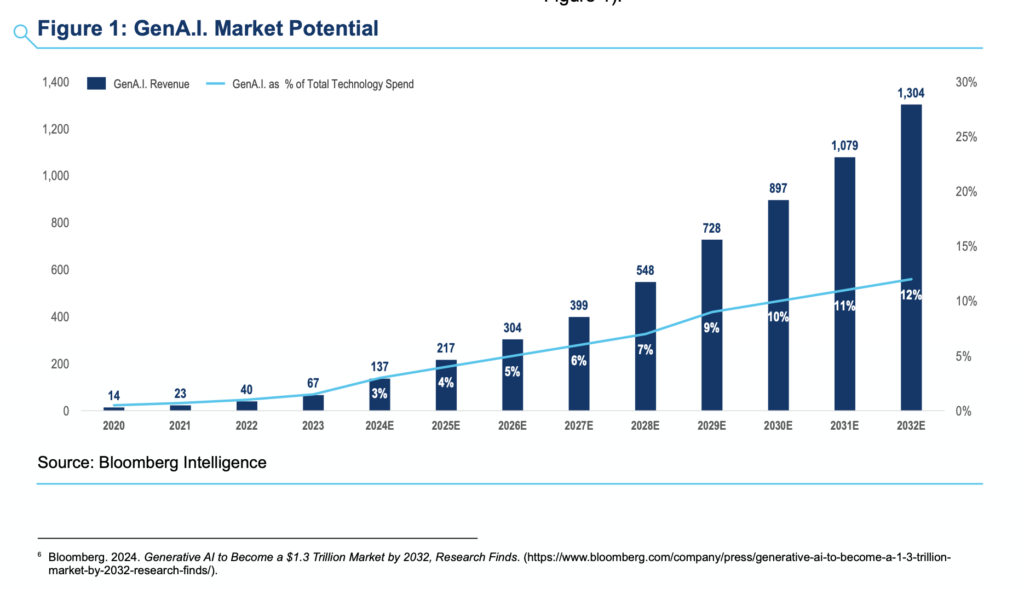

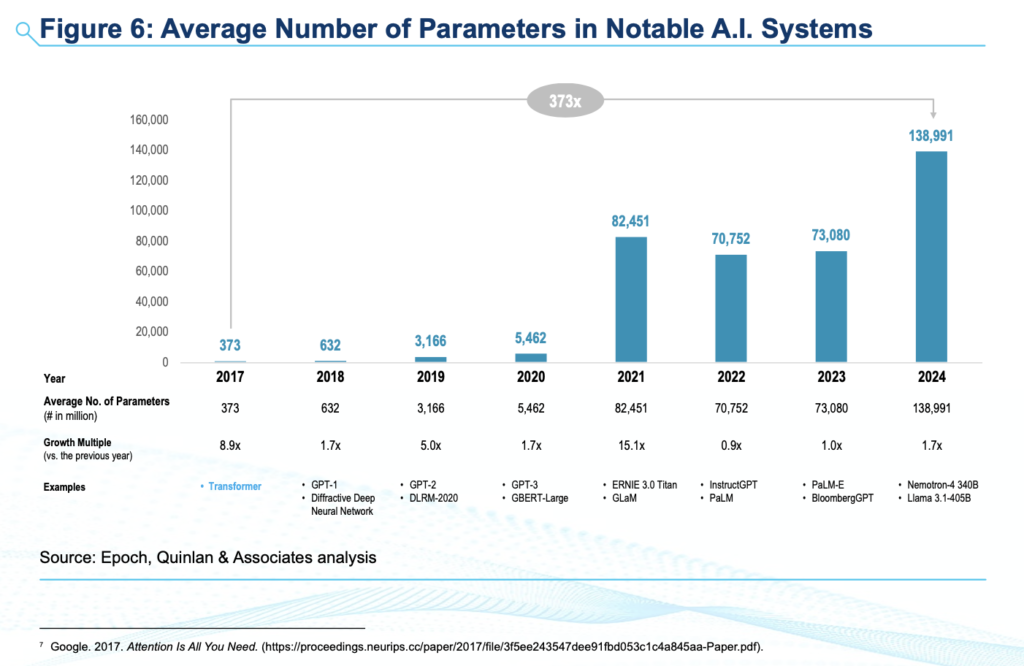

In 2024, Generative A.I. (GenA.I.) emerged as a game-changer in financial services, with institutions leveraging it primarily for internal compliance, risk management, and cybersecurity. These early applications helped streamline regulatory reporting, automate fraud detection, and improve operational efficiency. However, as GenA.I. adoption matures, the focus is shifting toward customer-facing applications, such as AI-powered financial advisory and automated decision-making. This transition brings both opportunities and challenges—creating a pressing need for stronger regulatory oversight and ethical AI governance.

Looking ahead, compliance will be the key battleground. Regulators, including the Hong Kong Monetary Authority (HKMA), are reinforcing principles of transparency, fairness, and data security to mitigate risks such as biased decision-making, hallucinations, and privacy breaches. The HKMA’s GenA.I. Sandbox is a pivotal step in this journey, enabling financial institutions to experiment with AI-driven compliance solutions in a controlled environment. As regulatory expectations evolve, firms that proactively align their GenA.I. strategies with compliance requirements will be better positioned to build trust, mitigate risks, and maintain a competitive edge.

This blog will revisit the major milestones in GenA.I. adoption, examine the shift from internal to customer-facing applications, and explore the roadmap for compliance in 2025. We’ll also highlight how leading financial institutions like HSBC, Standard Chartered, Bank of China (Hong Kong), and Hang Seng Bank are already leveraging AI for fraud detection, risk management, and cybersecurity—proving that GenA.I. isn’t just the future, it’s already here.

📌 Key Takeaways from the HKMA’s Research Paper

✔️ GenA.I. has already transformed compliance & risk management across banking, securities, and insurance.

✔️ Regulatory scrutiny is increasing, requiring more emphasis on transparency, fairness, and data security.

✔️ The HKMA’s GenA.I. Sandbox is shaping regulatory frameworks for responsible AI adoption.

✔️ Compliance is now a strategic advantage—firms that integrate GenA.I. responsibly will lead the future of finance.

📖 Reference: HKMA (2024). Generative Artificial Intelligence in the Financial Services Space

https://www.hkma.gov.hk/media/eng/doc/key-information/guidelines-and-circular/2024/GenAI_research_paper.pdf

Now, let’s map out what’s next for GenA.I. in financial compliance. 👇

🔥 Why This Matters: GenA.I. is Changing the Game

If you work in fintech, regtech, banking, or compliance, this isn’t just another tech trend—it’s a fundamental shift in how financial services operate. The rise of ChatGPT-like A.I. in compliance, fraud detection, and risk assessment is forcing financial institutions to rethink their strategies.

But here’s the challenge: GenA.I. is powerful, but it’s also unpredictable. It can hallucinate, generate biased outputs, and pose data security risks. Regulators are closely monitoring its development, and financial institutions cannot afford to get this wrong. 🚨

That’s why the HKMA’s research and regulatory initiatives are more important than ever. If you want to stay ahead in 2025, you must understand how to leverage GenA.I. while staying compliant.

🔍 The Shift: From Internal Use to Customer-Facing GenA.I.

Most financial institutions are currently using GenA.I. internally to automate compliance processes:

✅ Regulatory monitoring – Automating regulatory updates to ensure compliance in real time.

✅ KYC & AML – Identifying high-risk clients and flagging suspicious activities.

✅ Fraud detection & cybersecurity – Detecting anomalies and strengthening security measures.

✅ Compliance documentation – Generating audit reports, disclosures, and compliance reviews.

📌 What’s Next? The next wave of GenA.I. adoption will focus on external-facing applications, such as:

🚀 AI-powered chatbots for compliance queries and customer service.

💰 Personalized financial advice powered by GenA.I. insights.

🔍 Automated fraud investigation tools that interact with customers directly.

BUT—this shift comes with higher regulatory stakes. Financial institutions must ensure that all GenA.I.-driven interactions are accurate, fair, secure, and transparent.

🏦 GenA.I. in Action: How Banks Are Already Using AI for Compliance

GenA.I. in financial services isn’t just theoretical—it’s already powering real-world compliance solutions in some of the world’s largest banks. From fraud detection to cybersecurity and AML monitoring, major financial institutions are actively deploying AI-driven systems to enhance risk management, automate compliance, and strengthen security.

Here’s how GenA.I. is already shaping the industry today—and why it’s closer to you than you think.

🔹 HSBC’s Dynamic Risk Assessment (DRA) screens 1.2 billion transactions per month, using AI to detect money laundering patterns and reduce false positives by 60%.

🔹 Standard Chartered’s Name and Transaction Screening (NTS) leverages machine learning to analyze vast datasets, cutting false positives by 50% and improving fraud detection.

🔹 Bank of China (Hong Kong)’s AI-Powered Cybersecurity Framework strengthens digital security by using big data and blockchain to detect cyber threats in real time.

🔹 Hang Seng Bank’s Fraud Investigation Automation (FIA), developed in the HKMA’s GenA.I. Sandbox, enhances fraud detection by tracing hidden links between accounts and transactions.

What does this mean for the industry? AI-powered compliance is no longer optional—it’s becoming the industry standard.

⚖️ The Compliance Challenge: Balancing Innovation & Regulation

🚨 Key Risks of GenA.I. in Finance

🔴 Hallucinations – GenA.I. can generate misleading or inaccurate responses.

🔴 Bias & Fairness Issues – If trained on biased data, it can reinforce discrimination.

🔴 Data Security & Privacy Risks – Sensitive financial data may be exposed.

🔴 Accountability & Explainability – Who is responsible for A.I.-driven decisions?

📜 Regulatory Response in 2025

Regulators worldwide—including Hong Kong, the EU, the U.K., the U.S., and Singapore—are tightening their A.I. governance frameworks. The HKMA’s GenA.I. Sandbox is a critical initiative, allowing financial institutions to test AI-powered compliance solutions while receiving early regulatory feedback.

🔹 What This Means for You: If you are in the financial sector, compliance-first GenA.I. adoption is the only path forward.

📌 The Compliance Playbook: How to Stay Ahead

For financial institutions, the question is no longer should we adopt GenA.I.?—but how do we do it responsibly?

✅ 1. Build a Strong AI Governance Framework

🔹 Establish clear accountability for A.I.-driven compliance decisions.

🔹 Implement explainability measures to ensure transparency.

🔹 Adopt a “human-in-the-loop” approach for critical decisions.

✅ 2. Use AI for Proactive Compliance & Risk Management

🔹 Automate regulatory change monitoring to stay ahead of new laws.

🔹 Strengthen CDD & AML processes with AI-powered risk assessment.

🔹 Enhance fraud detection with real-time anomaly detection.

✅ 3. Prioritize Ethical & Responsible AI Adoption

🔹 Align with global AI ethics principles: fairness, security, accountability, and transparency.

🔹 Conduct regular bias tests to refine models.

🔹 Ensure data privacy protections to comply with regulations.

✅ 4. Participate in Regulatory Sandboxes & Industry Collaborations

🔹 Engage with the HKMA’s GenA.I. Sandbox to test AI innovations safely.

🔹 Partner with RegTech firms to co-develop AI compliance solutions.

🔹 Stay updated on emerging global AI regulations to remain compliant.

Final Thought: 2025 Is Not the Future—It’s Now

This is the moment to act. Financial institutions that take a proactive approach to GenA.I. governance, compliance, and ethical AI use will lead the future of finance.

📩 Need expert guidance? Contact Studio AM today to stay ahead of the compliance curve. 🚀