Unlocking the Greater Bay Area

How the Latest CEPA Amendment Creates a Golden Gateway for Startups

The Guangdong-Hong Kong-Macao Greater Bay Area (GBA) represents one of the most dynamic and opportunity-rich economic zones in the world. A megalopolis combining the strengths of nine Mainland cities with the international prowess of Hong Kong and Macao, the GBA is a powerhouse of innovation, finance, and trade. For ambitious startups, it’s a market of immense potential. However, historically, entry into the Mainland market, even with preferential policies, involved significant waiting periods.

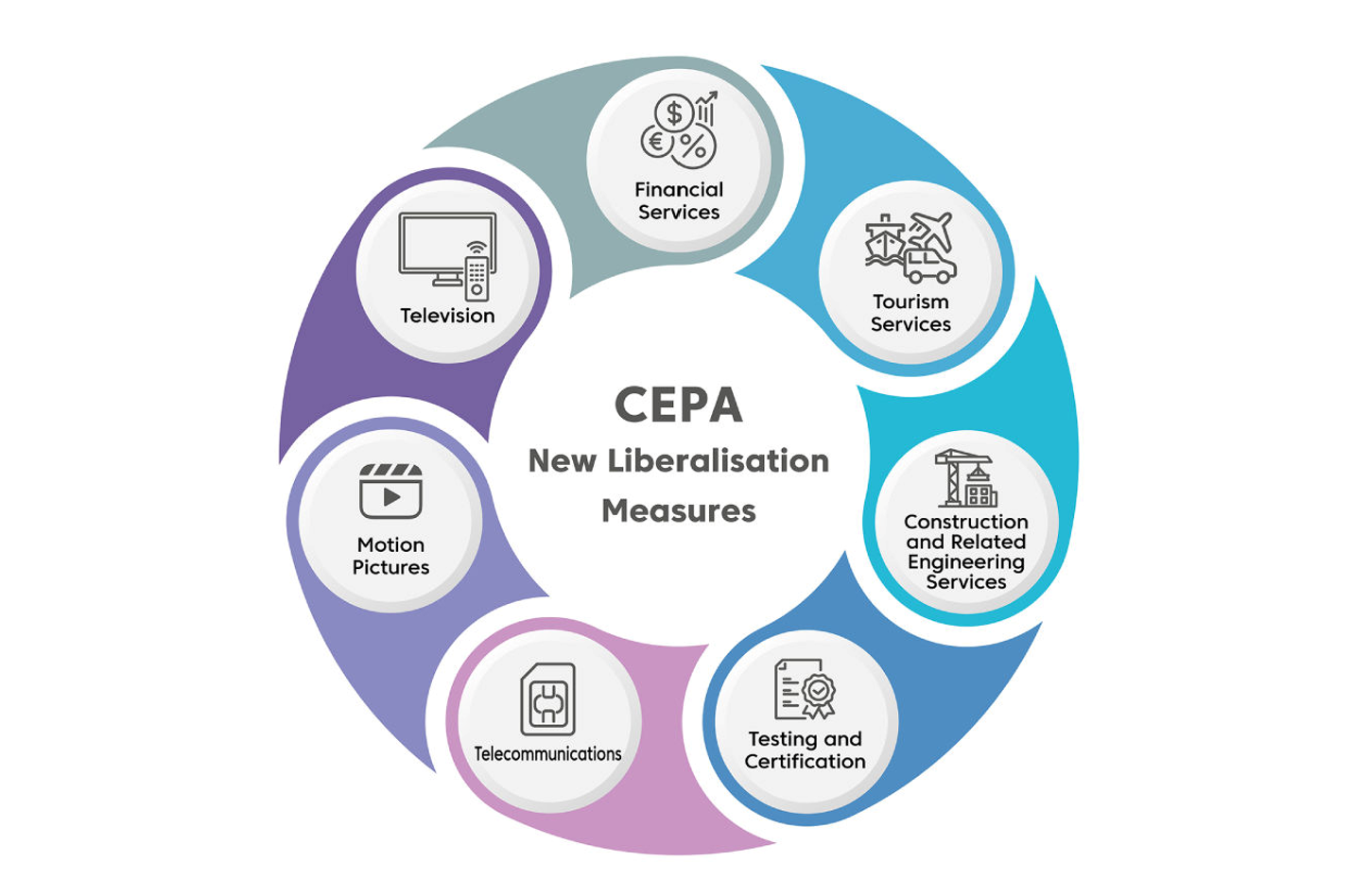

That landscape has now fundamentally changed. With the implementation of the Second Agreement Concerning Amendment to the CEPA Agreement on Trade in Services (Amendment II) on March 1, 2025, a critical barrier to entry has been dismantled. This policy update is not just an incremental change; it is a strategic invitation, especially for the startup community, to accelerate their cross-border ambitions.

For professional bankers, investors, and the financial institutions that support this ecosystem, understanding this shift is crucial. It signals a new wave of investment opportunities and a pressing need for expert guidance in navigating this newly opened gateway.

The Scale of Opportunity

To understand the impact of the new CEPA amendment, one must first appreciate the sheer scale of the existing economic relationship. For many years, the Mainland has been Hong Kong's largest service trade partner.

The continuous economic development of the Mainland has fueled a growing demand for high-quality services, and CEPA has been the primary channel for Hong Kong's industries to tap into this vast potential. The new amendment is set to dramatically accelerate this trend.

The Game-Changer: CEPA Amendment II

The Closer Economic Partnership Arrangement (CEPA) has long been the cornerstone of economic integration. The latest amendment, however, addresses a long-standing hurdle for new businesses.

The most significant change is the removal of the operational period requirement for Hong Kong service suppliers in most sectors. Previously, a Hong Kong company was required to have substantive business operations for at least three to five years before it could qualify for CEPA’s benefits. This effectively sidelined startups. With this rule now lifted, the timeline for GBA market entry has been dramatically shortened.

Your Step-by-Step Guide

For a FinTech founder, the GBA is likely already on your radar. The CEPA amendment is your accelerator. Here’s a practical roadmap to leverage this new advantage:

Step 1: Establish Your Hong Kong "Super-Connector" Presence

Your journey into the GBA begins in Hong Kong. To leverage CEPA, you must be a "Hong Kong service supplier." This means incorporating a company in Hong Kong and demonstrating "substantive business operations" through a local office, staff, and tax payments.

Step 2: Cash In Your Golden Ticket

The removal of the 3-to-5-year operational period requirement is your golden ticket. The strategy is now crystal clear: establish your Asian headquarters in Hong Kong, demonstrate substantive operations, and you can gain IMMEDIATE CEPA access to the Mainland.

Step 3: Choose Your GBA Landing Zone

The GBA is not a single market. Each city has its strengths. Shenzhen for tech, Guangzhou for trade, and Qianhai as a testbed for Hong Kong firms.

Step 4: Secure Your Operations

Cross-border operations involve risk. CEPA now allows you to stipulate that disputes be governed by Hong Kong law and arbitrated in Hong Kong, providing a massive confidence boost for investors.

Navigating with Confidence

While the CEPA Amendment II opens the door, walking through it successfully requires deep domain expertise. This is where a trusted partner becomes invaluable. As a compliance consultancy, Studio AM Limited is uniquely positioned to guide businesses through this new terrain, bridging the gap between ambition and execution.

The message is clear: the gateway to the Greater Bay Area is wide open. Is your business ready to step through?

Contact Studio AM Limited Today