2024’s Compliance Shake-Up: From Regulatory Burden to Strategic Weapon

Compliance is No Longer Just a Rulebook—It’s a Battleground

The financial industry has always been shaped by regulatory shifts, but 2024 marked a turning point. No longer just a set of rules to follow, compliance became a competitive differentiator, determining which firms could scale efficiently and which would be bogged down by regulatory roadblocks.

This past year saw record-breaking fines, global regulatory crackdowns, and a shift toward real-time compliance expectations. AI-driven financial services came under intense scrutiny as regulators demanded transparency, fairness, and accountability in automated decision-making. Embedded finance providers and fintech platforms faced new levels of oversight, with regulators holding them accountable for compliance failures across their entire ecosystem. Meanwhile, ESG compliance moved from a marketing tool to a legal requirement, forcing financial institutions to prove the integrity of their sustainability claims or risk reputational and financial damage.

As we enter 2025, the firms that treat compliance as an afterthought will struggle to survive, while those that embed compliance into their core operations will gain a powerful market advantage. The question is no longer “How do we stay compliant?” but rather “How do we turn compliance into a strategic asset that drives growth and trust?”

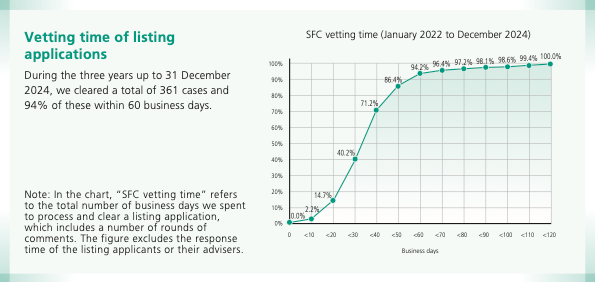

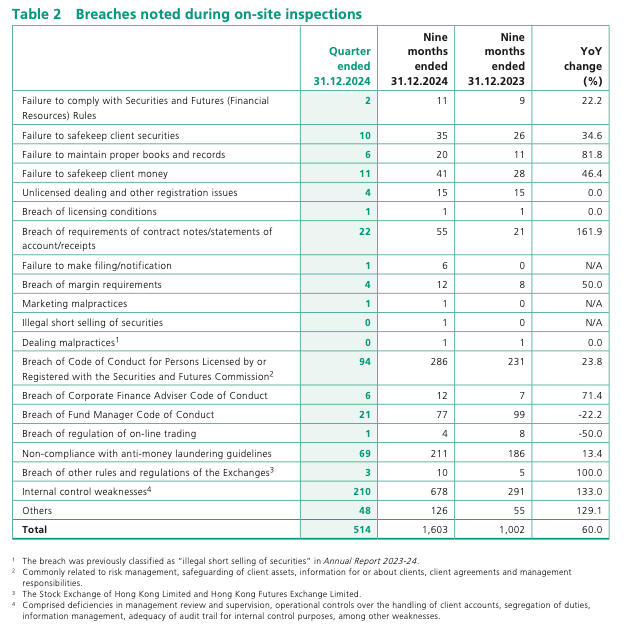

📖 Ref: SFC (2025). Quarterly Report October – December 2024.

https://www.sfc.hk/en/Published-resources/Corporate-publications/Quarterly-report

🤖 AI Regulation Caught Up—Now It’s Your Move

For years, AI-powered financial services operated in a regulatory gray area, advancing faster than oversight frameworks could evolve. In 2024, that era ended. Governments and financial regulators worldwide moved aggressively to tighten their grip on AI-driven decision-making, particularly in lending, risk assessment, and fraud detection.

The U.S. introduced the AI Accountability Act, requiring financial institutions using AI for credit scoring and loan approvals to demonstrate explainability, fairness, and the absence of bias in their models. The European Union’s AI Act categorized AI-driven financial services as high-risk, mandating bias audits, transparency reports, and human oversight before deployment. Meanwhile, China imposed pre-approval requirements for AI models used in trading and wealth management, ensuring that automated financial decisions could be traced and justified.

Regulatory scrutiny translated into real-world consequences. Several fintech lenders faced investigations for disparate impact violations, as regulators found that their AI models disproportionately denied credit to certain demographics. Lawsuits followed, leading to multi-million-dollar settlement agreements and forced overhauls of AI-driven underwriting models. On the other hand, financial giants like Goldman Sachs and JP Morgan proactively built AI governance frameworks ahead of regulatory mandates, allowing them to scale AI-powered investment products without facing delays or compliance hurdles.

Looking ahead to 2025, AI regulation will continue to evolve. Global financial firms will need to navigate a fragmented regulatory landscape, aligning with multiple AI governance frameworks simultaneously. Liability rules are shifting, making institutions directly responsible for the decisions made by their AI systems, regardless of whether those models were developed in-house or sourced from third-party vendors. AI audits will move from an occasional check to a continuous compliance requirement, forcing firms to implement real-time bias detection and explainability mechanisms.

For financial institutions, the challenge is clear: AI is no longer an unregulated frontier. Firms that fail to embed AI compliance into their systems from the outset will not only face regulatory penalties but also lose credibility in the eyes of investors and customers. Those that proactively build transparent, auditable AI models will not just avoid enforcement actions—they will become trusted leaders in the AI-driven financial ecosystem.

🚀 Compliance is No Longer a Department—It’s a Product Feature

The financial industry has moved beyond traditional compliance models. In 2024, compliance stopped being an isolated back-office function and became an integrated feature of financial products themselves. This was driven by the rise of Banking-as-a-Service (BaaS), embedded finance, and real-time transactions, where compliance failures could no longer be contained within a single institution but instead affected entire ecosystems.

Regulators responded by holding fintechs and embedded finance providers accountable not just for their own compliance, but for the compliance of their partners and service providers. This meant that a fintech offering embedded lending services could no longer assume that its banking partner would handle compliance—it had to demonstrate full regulatory oversight across all its financial products.

The shift toward real-time compliance monitoring was another major transformation. In the past, financial institutions relied on periodic audits to identify risks and compliance failures, but in 2024, regulators pushed for continuous compliance, requiring firms to detect fraud, money laundering, and sanctions violations as they happened. This forced institutions to integrate real-time compliance monitoring into their transaction processing systems, ensuring that suspicious activities were flagged and addressed immediately.

Fintech platforms also had to redesign their compliance infrastructure. Instead of treating KYC and AML checks as separate functions, they embedded regulatory APIs directly into their products, allowing for instant verification and fraud detection without disrupting the customer experience. As a result, compliance became a seamless, automated part of financial transactions rather than a cumbersome secondary process.

Looking ahead, these trends will continue to accelerate. Regulators will demand greater visibility into embedded finance ecosystems, requiring fintechs to demonstrate full compliance across their entire value chain. Financial institutions that fail to embed automated compliance mechanisms into their products will struggle to scale, while those that embrace real-time regulatory monitoring will gain faster approvals, stronger partnerships, and lower compliance costs.

🔍 Compliance is the New Trust Currency—And It’s Worth More Than Ever

2024 proved that compliance isn’t just a legal necessity—it’s a key driver of trust, reputation, and financial performance. Firms that treated compliance as a strategic asset saw higher investor confidence, stronger customer loyalty, and faster regulatory approvals, while those that cut corners faced fines, lawsuits, and reputational damage.

ESG compliance was one of the most visible battlegrounds. Regulators imposed over $4 billion in fines for greenwashing, cracking down on financial institutions that exaggerated their sustainability commitments. Investors responded by shifting capital toward firms with verifiable ESG credentials, making compliance a key factor in institutional investment decisions.

AML enforcement also intensified, with financial crime regulators issuing record penalties for inadequate transaction monitoring. Banks and fintechs that had invested in AI-driven fraud detection and blockchain analytics not only avoided fines but also became preferred banking partners for high-value clients looking for regulatory-safe financial institutions.

Consumer data protection was another major issue. Several large banks faced lawsuits over data privacy violations, prompting regulators to introduce stricter enforcement measures. Financial firms that proactively disclosed their data protection strategies and enhanced consumer privacy measures gained a competitive edge, attracting customers who prioritized security and transparency.

Looking ahead, compliance transparency will become a market expectation rather than an optional differentiator. Firms that proactively communicate their compliance efforts will secure stronger investor relationships, while those that fail to meet rising transparency demands will see declining customer trust and regulatory scrutiny.

⚡ 2025: The Year Compliance Becomes a Strategic Differentiator

The firms that succeed in 2025 will be those that shift their compliance mindset from reactive to proactive. AI governance, embedded compliance, and transparency will define the market leaders, while those that rely on outdated compliance models will struggle to compete.

At Studio AM, we help financial institutions, fintechs, and regtech firms turn compliance into their competitive edge. Whether it’s navigating AI regulations, embedding compliance into digital products, or ensuring global regulatory alignment, we provide the expertise and tools to transform compliance from a cost center into a growth accelerator.

🔥 This isn’t just a recap—it’s a roadmap for regulatory dominance in 2025.

🚀 Contact Studio AM today—let’s ensure your institution stays ahead of the curve.