Hong Kong’s Virtual Asset Roadmap: A Game-Changer for the Financial Industry

Why This Matters: The Boldest Regulatory Shift in Years

Hong Kong is making a decisive move to become a global leader in regulated virtual assets (VAs)—a shift that will have far-reaching implications for financial institutions, asset managers, fintech firms, and compliance professionals.

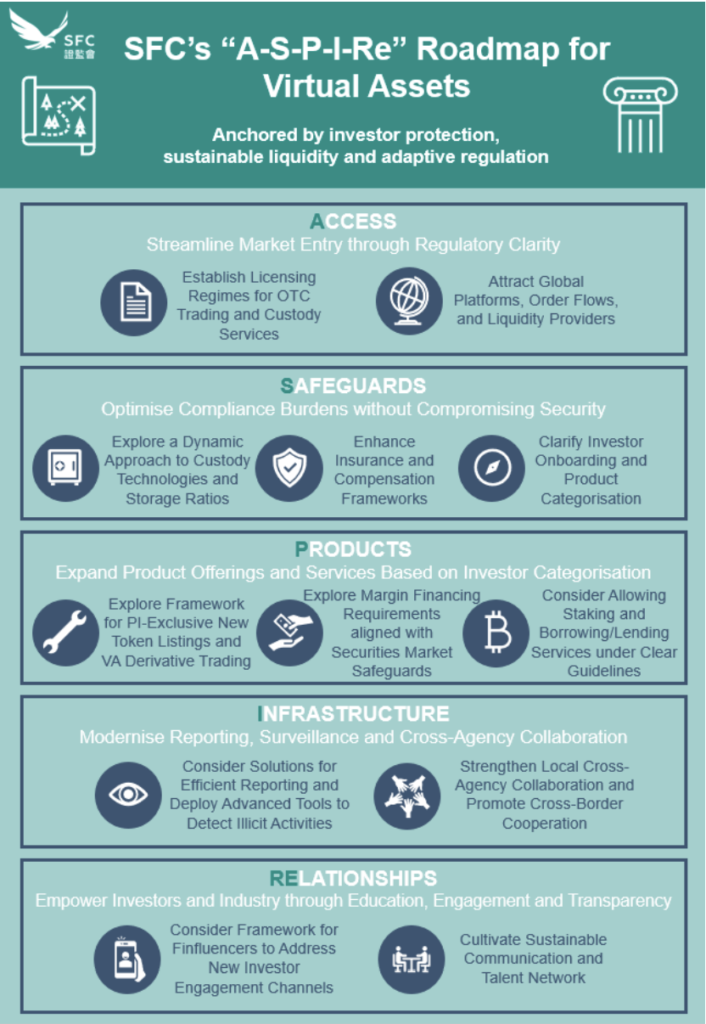

The Securities and Futures Commission (SFC) has introduced the “A-S-P-I-Re” roadmap, a comprehensive regulatory framework designed to institutionalize digital assets, attract global liquidity, and integrate traditional finance (TradFi) with blockchain innovation.

Unlike previous regulatory approaches, which either restricted or passively supervised the VA market, this roadmap is explicitly designed to encourage institutional participation while maintaining robust compliance safeguards.

Key Highlights of the Roadmap:

- Institutional capital is being welcomed with new licensing frameworks for OTC trading and VA custody services.

- Compliance is shifting from rigid mandates to adaptive, risk-based approaches.

- New opportunities for asset managers with regulated token listings, VA derivatives, staking, and lending.

- AI-driven oversight and surveillance tools to enhance fraud detection and AML enforcement.

- Stronger investor education and Finfluencer regulations to ensure market integrity.

For CEOs, compliance officers, asset managers, and fintech leaders, this is a watershed moment—one that will reshape financial services, compliance strategies, and investment opportunities in Hong Kong and beyond.

The question is: Are you ready to capitalize on these changes, or will your firm fall behind?

Ref: SFC, 2025. SFC sets out new roadmap to develop Hong Kong as a global virtual asset hub https://apps.sfc.hk/edistributionWeb/gateway/EN/news-and-announcements/news/doc?refNo=25PR20

Key Takeaways: What Financial Executives Need to Know

1. Institutional Liquidity is Coming—Prepare for a Surge in Capital

🔹 What’s changing?

- The SFC is actively inviting major liquidity providers, institutional investors, and global trading platformsto operate in Hong Kong.

- New licensing frameworks for OTC trading and VA custody services will allow banks, prime brokers, and hedge funds to legally operate in the VA space.

🔹 Who is impacted?

✅ Investment banks & prime brokers – Institutional liquidity in VA trading will increase dramatically.

✅ Hedge funds & asset managers – New token listings and derivatives will create opportunities for structured trades, arbitrage, and hedging.

✅ Wealth managers & private banks – Expect rising client demand for regulated virtual asset investment vehicles.

🔹 What should firms do?

Investment desks, trading teams, and institutional allocators should immediately assess their strategies for VA market entry, custody solutions, and structured product offerings.

2. Compliance is No Longer About Avoiding Fines—It’s a Competitive Edge

🔹 What’s changing?

- The SFC is moving away from rigid compliance mandates (e.g., fixed cold storage ratios) toward a flexible, risk-based model that allows firms to balance security with operational efficiency.

- AI-driven surveillance and blockchain analytics will be deployed for AML enforcement and fraud detection.

🔹 Who is impacted?

✅ CROs & Compliance Officers – Risk models must be updated for adaptive storage, AML controls, and real-time transaction monitoring.

✅ CIOs & CTOs – Cybersecurity, custody tech, and blockchain analytics must align with new compliance standards.

✅ VASPs & Crypto Exchanges – Stronger oversight on market conduct and liquidity transparency.

🔹 What should firms do?

Financial institutions must invest in regtech solutions, AI-driven transaction monitoring, and automated compliance frameworks to ensure they stay ahead of Hong Kong’s evolving regulatory landscape.

3. Virtual Asset Derivatives & Tokenization Will Reshape Capital Markets

🔹 What’s changing?

- The SFC is exploring regulated token listings, derivatives trading, staking, and lending—initially for professional investors.

- Tokenized real-world assets (RWAs) and VA-backed structured products will appeal to institutional investors seeking exposure to digital finance.

🔹 Who is impacted?

✅ Investment banks & structured product teams – New opportunities in VA derivatives, tokenized bonds, and hybrid financial instruments.

✅ Asset managers & hedge funds – New trading strategies will emerge, including basis trades, structured derivatives, and arbitrage across regulated exchanges.

✅ Retail banks & wealth platforms – Staking and lending services will create new fixed-income alternatives.

🔹 What should firms do?

Financial institutions should develop pricing models, risk frameworks, and structured investment products to capture first-mover advantage in this evolving market.

4. AI-Driven Compliance & Surveillance Will Redefine Risk Management

🔹 What’s changing?

- The SFC is deploying real-time data-driven surveillance tools to detect fraud, market abuse, and cross-border illicit activities.

- Regulators will require straight-through reporting of digital asset transactions, making traditional compliance models obsolete.

🔹 Who is impacted?

✅ Regulatory & Compliance Teams – More stringent reporting, faster enforcement, and AI-driven risk monitoring.

✅ Trading Desks & Market Makers – New surveillance tools will impact trading strategies and market-making operations.

✅ Cybersecurity & Risk Teams – Blockchain forensic analysis will be critical for AML compliance and fraud prevention.

🔹 What should firms do?

Firms must adopt AI-driven regulatory intelligence platforms that can monitor transactions, flag suspicious activity, and automate compliance reporting.

What’s Next? Predictions & Strategic Implications

- Hong Kong Will Become Asia’s Leading Regulated Virtual Asset Hub

- Clear regulations, institutional safeguards, and cross-border liquidity will position Hong Kong as the dominant VA hub in Asia, surpassing Singapore and other regional players.

- Institutional Capital Will Flood into Tokenized & Derivative Markets

- Expect a surge in hedge fund, family office, and institutional allocations to regulated VA products, tokenized RWAs, and structured investment vehicles.

- AI-Driven Regtech Will Become a Necessity, Not an Option

- AI-powered compliance tools will be required to meet expanding regulatory oversight, real-time transaction monitoring, and fraud detection mandates.

- The Lines Between Traditional Finance & Virtual Assets Will Blur

- Banks, asset managers, and trading firms will increasingly integrate tokenized securities, blockchain-based settlements, and hybrid custody solutions.

🎯 Conclusion: The Time to Act is Now

The SFC’s A-S-P-I-Re roadmap is more than just regulation—it’s a reshaping of Hong Kong’s financial landscape.

For financial institutions, the opportunity is clear:

- Proactively engage with licensing opportunities for virtual asset trading, custody, and structured investments.

- Invest in AI-driven compliance solutions to stay ahead of regulatory expectations.

- Prepare for institutional capital inflows into tokenized assets and derivatives.

At Studio AM, we specialize in helping financial firms navigate complex regulatory changes, implement compliance automation, and develop forward-thinking fintech strategies.

📌 Want to future-proof your financial institution in the virtual asset era?

📌 Need expert guidance on compliance, licensing, or risk management?

🚀 Contact Studio AM today to ensure your firm stays ahead in Hong Kong’s evolving virtual asset landscape.