Cracking Down or Cracking Under Pressure? The Hidden Risks in Hong Kong’s Banking Compliance

Introduction: A Growing Storm in Banking Compliance

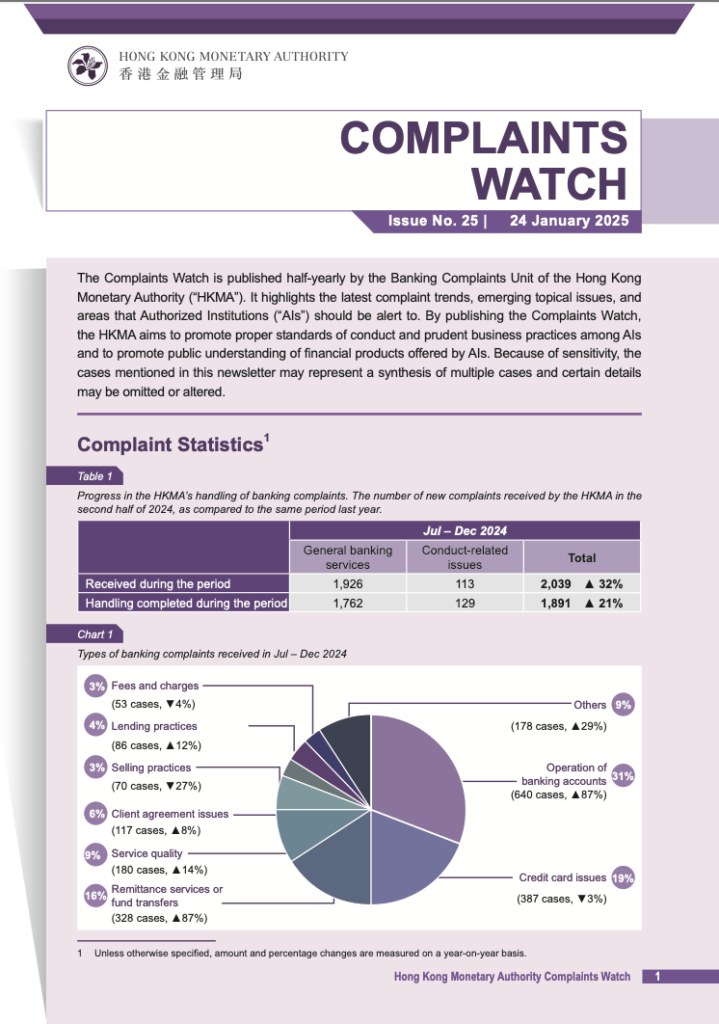

The latest Complaints Watch report from the Hong Kong Monetary Authority (HKMA) has revealed a sharp rise in banking complaints, signaling an urgent challenge for financial institutions. With a 32% surge in complaints in the second half of 2024, the banking sector is facing increasing pressure from both regulatory enforcement and customer dissatisfaction.

The most striking trend? A 64% rise in complaints related to banking account operations, driven by stricter fraud monitoring, enhanced intelligence sharing between banks and law enforcement, and more aggressive account reviews. While these measures aim to combat financial crime, they have also resulted in unexpected account freezes, transaction delays, and growing frustration among customers.

But this is not just about numbers. It’s a warning sign. Financial institutions are caught between regulatory demands for stricter compliance and customer expectations for seamless banking experiences. Those that fail to find the right balance risk regulatory penalties, reputational damage, and operational inefficiencies.

So, what does this mean for banks, fintech firms, and compliance professionals? How should financial institutions prepare for the next wave of regulatory scrutiny? Let’s break down the key takeaways and what they mean for the future of banking compliance.

📖 Reference: HKMA (2025). Complaints Watch https://www.hkma.gov.hk/media/eng/doc/key-information/guidelines-and-circular/2025/20250124e2.pdf

📌 Key Takeaways: The Most Critical Compliance Challenges Banks Must Address

1. The Surge in Account Freezes: A Necessary Evil or a Looming Crisis?

🔹 What’s happening?

- Complaints about banking account operations surged by 64%, reaching 640 cases in just six months.

- The spike is directly linked to stricter fraud monitoring and intelligence-sharing initiatives between banks and law enforcement.

- While these measures help combat fraud, they also lead to legitimate customers being caught in the crossfire.

🔹 Why it matters:

- Banks must navigate the fine line between fraud prevention and customer experience.

- Regulators expect financial institutions to enhance fraud detection, but customers demand transparency and accessibility to their accounts.

- If banks don’t refine their fraud detection frameworks, they risk alienating customers and triggering more regulatory scrutiny.

🔹 How financial firms should respond:

- Adopt AI-powered fraud detection systems to minimize false positives while maintaining strong security.

- Develop clear customer communication protocols—clients should not find out their accounts are frozen only after transactions fail.

- Implement an appeals process for account freezes, ensuring that legitimate users can regain access quickly.

2. Reputation at Risk: Why Handling Customer Complaints is Now a PR Battle

🔹 What’s happening?

- The HKMA highlighted a high-profile case where a customer dispute over an ATM deposit discrepancy turned into a media controversy.

- The bank in question acted swiftly—reviewing CCTV footage, conducting a thorough investigation, and issuing a legally sound media response.

- The result? The bank retained customer trust while protecting its reputation.

🔹 Why it matters:

- Complaints are no longer just a banking issue—they’re a public relations crisis waiting to happen.

- Regulators and the media are closely watching how financial institutions handle consumer grievances.

- A poorly handled complaint can escalate from a regulatory issue to a full-blown reputational disaster.

🔹 How financial firms should respond:

- Develop a standardized crisis response plan for handling public complaints and media scrutiny.

- Ensure all complaint-handling procedures are legally vetted to withstand public and regulatory challenges.

- Proactively share investigation results with customers to prevent unnecessary escalations.

3. Debt Collection Under Fire: Are Banks Still Responsible for Sold Debts?

🔹 What’s happening?

- A finance company attempted to collect a debt that had been sold by a bank eight years earlier—without proper documentation.

- The HKMA criticized the bank for failing to ensure that third-party debt buyers followed fair collection practices.

- The case exposed gaps in accountability when banks offload debts to external firms.

🔹 Why it matters:

- Selling a debt does not eliminate a bank’s responsibility for ensuring fair treatment of borrowers.

- Regulators are cracking down on aggressive, undocumented debt collection tactics.

- If banks don’t monitor their debt buyers, they could face regulatory penalties.

🔹 How financial firms should respond:

- Audit all third-party debt buyers to ensure compliance with ethical collection practices.

- Mandate clear documentation standards for any debt sold to external firms.

- Establish a borrower dispute resolution process to prevent regulatory interventions.

4. Credit Card Fraud Liability: Are Banks Pushing the Limits of Consumer Responsibility?

🔹 What’s happening?

- Multiple complaints emerged where banks held consumers liable for unauthorized transactions, citing failure to safeguard the card as justification.

- The HKMA reminded banks that consumer liability for unauthorized transactions is capped at HK$500, unless gross negligence is proven.

🔹 Why it matters:

- Banks must justify liability claims with clear evidence of negligence.

- Consumers are becoming more aware of their rights, increasing dispute rates.

- Regulators are signaling a stricter stance on consumer protection.

🔹 How financial firms should respond:

- Ensure fraud liability policies align with HKMA guidelines—avoid over-attributing blame to customers.

- Enhance fraud prevention systems to reduce unauthorized transactions in the first place.

- Improve dispute resolution processes to assess each case fairly and transparently.

🔍 Predictive Insights: What’s Next for Banking Compliance?

1. Stricter Fraud Monitoring Will Lead to New Consumer Protection Rules

By 2026, regulators may require banks to offer real-time fraud transparency dashboards, allowing customers to track potential fraud flags and appeal decisions digitally.

2. Public Complaint Disclosures Will Become a Regulatory Standard

By 2027, the HKMA may introduce mandatory public disclosure requirements for major complaint categories, forcing banks to be more transparent about how they handle disputes.

3. Debt Collection Licensing Requirements Will Tighten

By 2025, expect the HKMA to introduce stricter licensing requirements for debt purchasers, making banks directly accountable for how their sold debts are collected.

4. Automated Fraud Dispute Resolution Will Become Mandatory

By 2026, the HKMA may introduce automated fraud dispute resolution requirements, forcing banks to provide real-time justifications for liability claims.

🎯 Conclusion: The Compliance Landscape is Changing—Are You Ready?

The latest HKMA Complaints Watch is more than just a report—it’s a clear warning that regulatory expectations are evolving rapidly.

Banks that fail to adapt will face increased complaints, regulatory intervention, and reputational risks.

Those that proactively refine their fraud detection, customer engagement, and debt collection strategies will gain a competitive edge.

At Studio AM, we specialize in helping financial institutions navigate regulatory changes, optimize compliance frameworks, and build future-proof risk management strategies.

📌 Need expert guidance on fraud monitoring, debt collection oversight, or compliance automation?

🚀 Contact Studio AM today—let’s ensure your institution stays ahead of the curve.