Beyond Washington's New Blueprint: How the U.S. GENIUS Act Creates a Trillion-Dollar RWA and Stablecoin Opportunity for Hong Kong

The new U.S. report signals a major shift in the global regulatory landscape for digital assets.

Source: Read the full report, "Strengthening American Leadership in Digital Financial Technology"

Let’s move beyond the surface-level summaries. The new U.S. digital asset report—published just yesterday—is not just another policy paper; it is a meticulously crafted strategic playbook. For years, Hong Kong has rightfully built its status as a premier digital asset hub by offering what the U.S. lacked: regulatory clarity. That era of competitive advantage through arbitrage is now officially over.

As compliance professionals in Hong Kong, we must dissect this report not for what it says, but for what it *does*. It lays the groundwork for specific legislation that will fundamentally reshape global capital flows, talent acquisition, and technological standards. This analysis provides a granular, no-nonsense breakdown of the report's most critical components and their direct impact on Hong Kong-based institutions.

Washington's New Digital Financial Technology Blueprint.

Beyond 'Clarity': The Strategic Implications of the CLARITY Act

The most immediate challenge to Hong Kong's VASP regime comes from the report's full-throated endorsement of the Digital Asset Market Clarity Act of 2025 (CLARITY). This is far more than just "providing clarity."

The Core Change: Ending the SEC vs. CFTC Turf War

The report's key recommendation is to grant the Commodity Futures Trading Commission (CFTC) exclusive authority over the spot markets for non-security digital assets. [p. 54-55] This is a surgical strike against the single greatest source of regulatory uncertainty in the U.S. market. For years, firms have been caught in the crossfire, unsure if assets like Ether were securities under the SEC or commodities under the CFTC. By drawing a clear line, the U.S. is not just creating rules; it's creating a fast lane for institutional investment into the largest asset class within the crypto ecosystem.

Why This Directly Impacts Hong Kong

Our competitive edge was built on the SFC providing a single, clear framework. The CLARITY Act effectively neutralizes that advantage. The new battleground will not be clarity, but the efficiency, depth, and liquidity of the market. Once U.S. exchanges, custodians, and asset managers can operate with this newfound certainty, the gravitational pull of U.S. capital markets will become immense. Hong Kong firms must now prepare to compete on service, innovation, and their unique position as a gateway to Asia, because the regulatory "safe harbor" argument has been significantly weakened.

The GENIUS Act: A Masterstroke in Financial Diplomacy

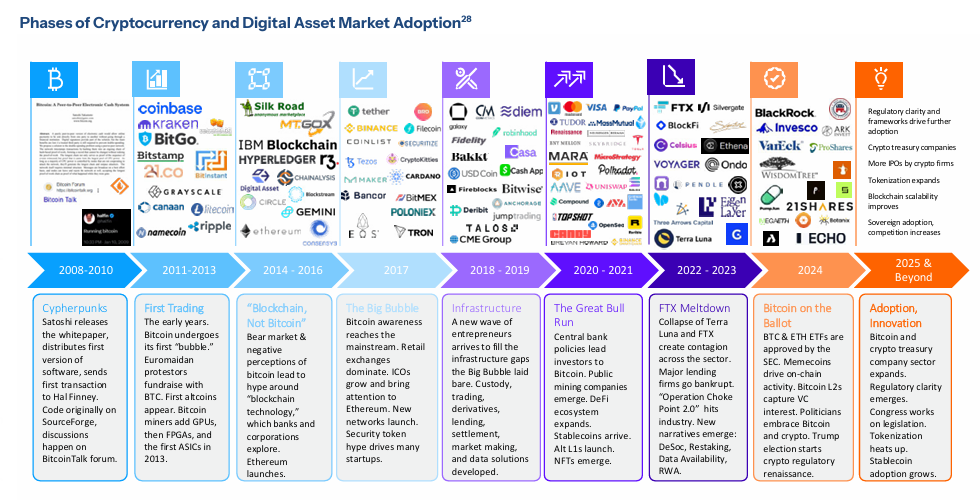

Phases of Cryptocurrency and Digital Asset Market Adoption (Captured from the Report).

The report's section on stablecoins, centered on the Global Enterprise for Networked and Unified Stablecoins (GENIUS) Act, is arguably its most important from a global perspective. It is a direct move to codify the U.S. dollar's dominance for the next generation of finance.

The Mandate: Federally Licensed, Dollar-Backed, and Private

The GENIUS Act establishes a federal licensing regime for stablecoin issuers, mandating 1:1 reserves of high-quality liquid assets like cash and short-term Treasuries. [p. 93-94] Crucially, it champions a private sector-led model while explicitly recommending against a retail-facing U.S. Central Bank Digital Currency (CBDC). [p. 95] This is a powerful signal to the market: the U.S. wants innovation to come from the private sector, but within a fortress of federal oversight.

The most strategic clause within the GENIUS Act is its provision for reciprocity. It allows foreign stablecoin issuers from jurisdictions with "comparable" regulatory regimes to access the U.S. market. [p. 93]

The Challenge and Opportunity for the HKMA and Local Issuers

This presents both a high bar and a golden opportunity. For the HKMA, the pressure is now on to ensure its own stablecoin sandbox and eventual regime are perceived as "comparable" to this new U.S. federal standard. If we succeed, Hong Kong-based issuers could gain a streamlined path into the world's most liquid market. If we fail, they could be locked out. For local financial institutions, the proliferation of federally-backed USD stablecoins creates a massive opportunity. Hong Kong, as a top global USD clearing center, is perfectly positioned to become the primary hub in the Asian time zone for the clearing, settlement, custody, and FX management of these new digital dollars. This is a concrete business line that compliance and strategy teams should be planning for *today*.

A Sophisticated AML/CFT Stance: Regulating Control, Not Code

The report's approach to illicit finance and DeFi shows a remarkable level of technical understanding, moving far beyond the blunt instruments of the past.

The Landmark Clarification for DeFi

The report makes a critical recommendation: regulatory obligations should follow control. It explicitly states that software developers and others who do not have "total independent control over value" should not be treated as money transmitters under the Bank Secrecy Act. [p. 108] This is a watershed moment. It distinguishes between the creator of a decentralized protocol and the operators of a centralized, custodial service. Furthermore, the report enshrines the right to self-custody for law-abiding citizens, rejecting calls for a ban on self-hosted wallets. [p. 108]

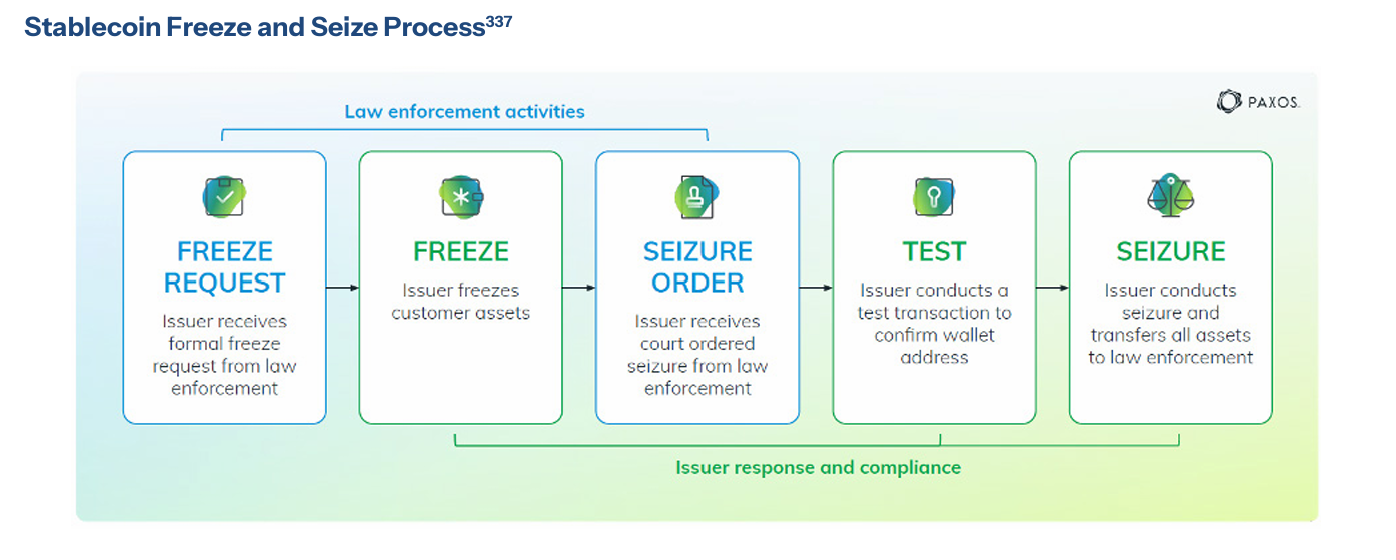

Stablecoin Freeze and Seize Process (Captured from the Report)

What This Means for Hong Kong Compliance Teams

This provides a powerful reference model for Hong Kong as it develops its own DeFi policy. For compliance officers, the takeaway is clear: the future is not about prohibiting interaction with DeFi. It is about implementing sophisticated, risk-based controls. This means investing heavily in on-chain analytics tools to trace the source and destination of funds, performing robust due diligence on the specific protocols being interacted with, and focusing AML controls on the centralized on- and off-ramps where value enters and exits the regulated system. A blanket ban is no longer a viable or forward-looking strategy; intelligent risk management is.

The Quiet Endorsement: Real World Assets (RWA) and the Next Frontier

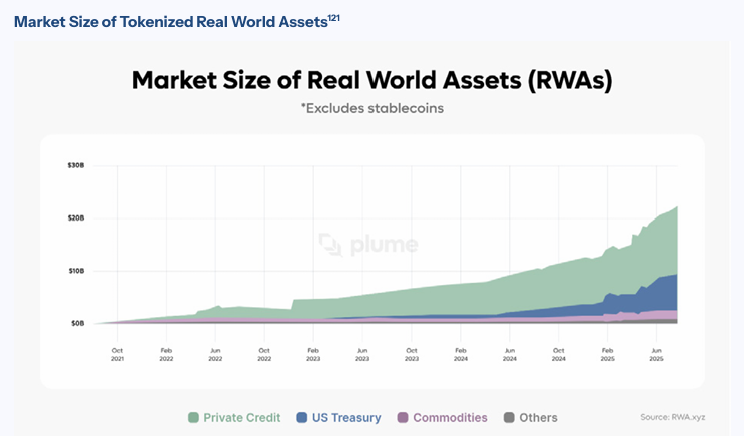

Market Size of Tokenized RWA (Captured from the Report).

While the report focuses heavily on native digital assets, its principles create the most robust framework yet for the tokenization of Real World Assets (RWAs). By clarifying what falls under the CFTC, it implicitly solidifies the SEC's jurisdiction over everything else that meets the Howey Test—which includes nearly all conceivable RWA-backed tokens.

Applying Existing Securities Law with Confidence

The report champions a "same activity, same risk, same regulation" approach, effectively stating that the tokenization of a bond or a piece of real estate does not require exotic new laws, but the confident application of existing securities frameworks. [p. 60-62] This seemingly simple stance is a green light for major institutions like BlackRock and Franklin Templeton, who can now leverage their expertise in securities law and apply it to a tokenized environment with much greater legal certainty.

Hong Kong's Niche: The Race to Tokenize Asian Assets

This is where the competition becomes specific. While the U.S. is poised to dominate the tokenization of U.S. Treasurys and other domestic assets, Hong Kong has a unique opportunity to become the premier global hub for tokenizing Asian RWAs. Our legal system, proximity to capital, and deep understanding of regional assets—from Japanese real estate to private credit deals in Southeast Asia—are our key differentiators. The SFC has already laid the groundwork with its guidance on tokenized securities. The challenge now is to execute: to build the trusted, compliant, and liquid marketplaces for these specific assets before U.S. players attempt to do it from afar. This is not just a technology race; it's a race for jurisdictional specialization.

Conclusion: From Arbitrage to Excellence - Hong Kong's Moment of Truth

The U.S. has laid its cards on the table. The strategy is no longer containment but aggressive, regulated growth. For Hong Kong, the comfort of being the "clearer" jurisdiction is gone. The new imperative is to be the *better* jurisdiction—more efficient, more innovative, and more deeply integrated into the fabric of Asian finance.

Firms in Hong Kong must now act with urgency and precision. The conversation in your boardroom must change from "How do we comply?" to "How do we compete in this new paradigm?"

- Conduct a Gap Analysis: Immediately benchmark your compliance frameworks not just against SFC rules, but against the specific tenets of the CLARITY and GENIUS Acts. Where are the gaps in your operational readiness?

- Re-evaluate Product Roadmaps: The opportunity in providing services around regulated USD stablecoins and tokenized Asian RWAs is now concrete. Is your firm positioned to act as a custodian, market maker, or clearing agent for these instruments?

- Lobby and Engage: Hong Kong's industry bodies and regulators must proactively engage with their U.S. counterparts to ensure our local regime is understood and achieves "comparable" status. The future market access of our entire industry could depend on it.

The era of easy wins is over. An era of fierce, regulated, global competition has begun. As your compliance partners, we are here to help you navigate this terrain and build a strategy not just for survival, but for leadership.