Greentech in Banking: HKMA Latest Data-Driven Compliance and Risk Management Imperative

The Convergence of Regulation, Risk, and Opportunity

The Hong Kong Monetary Authority (HKMA)’s 2025 Adoption Practice Guide on Greentech in the Banking Sector underscores a critical shift in the financial industry: compliance with climate-related regulations is no longer just a regulatory burden—it is a fundamental component of risk management, operational resilience, and strategic differentiation.

This guide builds on the HKMA’s broader Fintech Promotion Roadmap, launched in August 2023, which identified five key focus areas for Hong Kong’s fintech development:

- Wealth/Investech – Driving digital transformation in wealth and asset management.

- Insurtech – Enhancing innovation in insurance services.

- Greentech – Leveraging financial technology to support climate-related risk management and green finance.

- Artificial Intelligence (A.I.) – Accelerating the adoption of A.I.-driven solutions in the financial sector.

- Distributed Ledger Technology (DLT) – Exploring blockchain applications in banking, payments, and compliance.

Among these areas, Greentech has gained significant traction, particularly as financial institutions (FIs) face increasing pressure from regulators, investors, and customers to integrate climate risk considerations into their business models.

📖 Reference: HKMA (2025). Adoption Practice Guide on Greentech in the Banking Sector. Adoption Practice Guide on Greentech in the Banking Sector

Why is the HKMA Pushing for Greentech?

- In November 2020, the HKMA co-launched the Alliance for Green Commercial Banks with the International Finance Corporation (IFC), aiming to drive sustainable finance innovation.

- In May 2020, the HKMA and the Securities and Futures Commission (SFC) co-initiated the Green and Sustainable Finance Cross-Agency Steering Group (CASG) to align Hong Kong’s regulatory framework with global climate risk management standards.

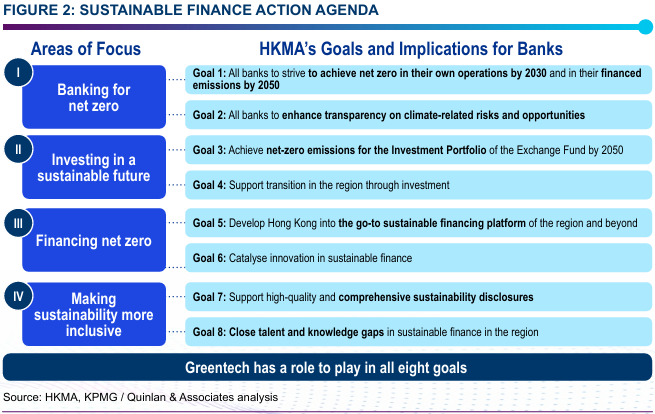

- In October 2024, the HKMA introduced its Sustainable Finance Action Agenda, outlining clear goals for banks to achieve net zero in operations by 2030 and net zero financed emissions by 2050.

For financial institutions, including banks, fintechs, and regtech firms, the integration of Greentech solutions is not just about meeting HKMA’s compliance requirements—it is about harnessing data-driven insights to mitigate risks, optimize operations, and unlock new growth opportunities.

This blog post distills the key takeaways from the HKMA guide, emphasizing real-world use cases, data challenges, and actionable insights to help financial institutions navigate the evolving compliance landscape.

Why Greentech Matters for Financial Institutions

The Regulatory Push: From Disclosure to Actionable Climate Risk Management

The HKMA’s Sustainable Finance Action Agenda sets forth clear mandates for financial institutions:

- Banks must achieve net-zero operations by 2030 and net-zero financed emissions by 2050.

- Climate-related risks must be integrated into financial decision-making, risk modeling, and reporting frameworks.

- Compliance with international sustainability disclosure standards (ISSB, BCBS) is now a baseline expectation.

The traditional approach of manually compiling climate risk disclosures is no longer viable. Institutions must now deploy Greentech solutions to automate ESG data collection, standardize reporting, and enhance climate risk modeling.

📊 Data Challenge:

- Climate risk data is fragmented, inconsistent, and often lacks standardization.

- Financial institutions struggle to aggregate emissions data from borrowers, making it difficult to assess financed emissions (Scope 3).

- HKMA’s Hong Kong Taxonomy for Sustainable Finance provides a framework for classifying green assets, but many banks lack the data infrastructure to implement it effectively.

🚀 Opportunity for Financial Institutions:

- Leverage Greentech-powered ESG data aggregation platforms to automate climate risk reporting and align with regulatory frameworks.

Integrate real-time carbon footprint tracking into banking operations to enhance both regulatory compliance and customer engagement.

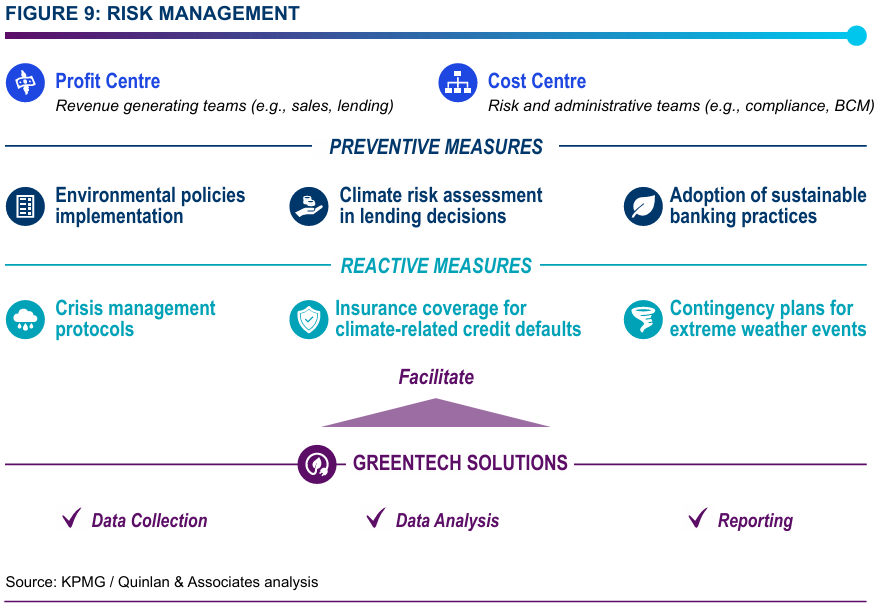

1. Use Case: Risk Management with Multi-Vendor Greentech Partnerships

📌 Challenge:

A global bank faced challenges in assessing transition risks (e.g., regulatory shifts, carbon pricing policies) due to data inconsistencies across jurisdictions.

⚡ Greentech Solution:

- The bank partnered with multiple Greentech vendors to enhance its climate risk models, integrating physical and transition risk indicators into credit assessments.

- Scenario analysis and stress testing were conducted using Greentech-powered climate value-at-risk assessments.

- Data aggregation platforms were deployed to harmonize ESG data across global markets, ensuring comparability and regulatory alignment.

🔍 Key Learnings:

- Data Source Verification is Critical – The bank rigorously vetted Greentech vendors to ensure data credibility, methodological transparency, and regulatory compliance.

- Agile Implementation Accelerates Adoption – A phased proof-of-concept (PoC) approach allowed the bank to test and refine Greentech solutions before full-scale deployment.

- Cross-Department Collaboration is Essential – Effective risk management required coordination between compliance, risk, and technology teams to integrate Greentech solutions seamlessly.

🚀 Strategic Takeaway:

- Banks must shift from static climate risk reporting to dynamic, data-driven risk modeling.

- Regtech firms should develop modular, API-driven Greentech solutions that can be rapidly deployed and scaled across financial institutions.

2. Use Case: Expanding Sustainable Finance with ESG-Based Credit Assessment

📌 Challenge:

SMEs often lack the ESG reporting capabilities needed to qualify for Sustainability-Linked Loans (SLLs), restricting access to green finance.

⚡ Greentech Solution:

A regional bank partnered with a Greentech-powered ESG intelligence platform to automate ESG scoring for SME borrowers.

🔍 Key Learnings:

- Lowering the Barrier to Entry for SMEs – By leveraging Greentech-powered ESG scoring, the bank reduced the cost and complexity of ESG assessments, expanding access to sustainable finance.

- Enhancing Loan Portfolio Resilience – The bank mitigated climate-related credit risks by ensuring that borrowers adhered to sustainability performance metrics.

- Standardizing ESG Data Collection – The Greentech platform automated data aggregation from multiple sources, ensuring consistency, comparability, and regulatory alignment.

🚀 Strategic Takeaway:

- Banks and fintechs must integrate automated ESG scoring into loan underwriting processes to expand access to green finance.

Regtech firms should develop ESG compliance tools that streamline SME sustainability assessments, making sustainable finance more accessible.

3. Use Case: Customer Engagement via Carbon Footprint Tracking

📌 Challenge:

Consumers increasingly demand transparency on how their financial behaviors impact the environment, but traditional banking platforms lack carbon tracking capabilities.

⚡ Greentech Solution:

A global bank integrated a carbon impact module into its mobile banking app, enabling customers to:

- Track carbon footprints in real time based on spending patterns.

- Receive personalized sustainability recommendations to reduce environmental impact.

- Access green financial products (e.g., ESG funds, green bonds, carbon offset programs) directly within the app.

🔍 Key Learnings:

- Gamification Drives Engagement – The module used interactive visual elements (e.g., “watering the plant” animations) to encourage sustainable spending behaviors.

- Seamless Integration is Key – API-driven Greentech solutions enabled the carbon tracking module to be embedded directly within the bank’s existing app infrastructure.

- Regulatory Compliance and Customer Engagement Can Coexist – The solution enhanced both regulatory ESG disclosures and customer experience, creating a competitive differentiator.

🚀 Strategic Takeaway:

- Banks must integrate Greentech-powered carbon tracking tools into consumer banking platforms to drive sustainability engagement and meet evolving ESG disclosure requirements.

Fintechs should develop embedded Greentech solutions that seamlessly integrate into banking apps, payments platforms, and wealth management services.

Compliance is Now a Competitive Advantage

🔍 What Financial Institutions Must Do Now:

- Invest in ESG data infrastructure – Partner with Greentech and regtech providers to automate sustainability reporting and climate risk modeling.

- Embed climate risk into financial decision-making – Integrate Greentech-powered risk assessment tools into lending, investment, and treasury functions.

- Engage customers through sustainable finance offerings – Expand ESG-linked credit products, carbon tracking tools, and green investment portfolios.