Hong Kong’s Fintech Future: A 2025 Perspective on the HKMA’s Fintech Promotion Roadmap

Beyond the Hype: What the HKMA’s Fintech Roadmap Means in 2025

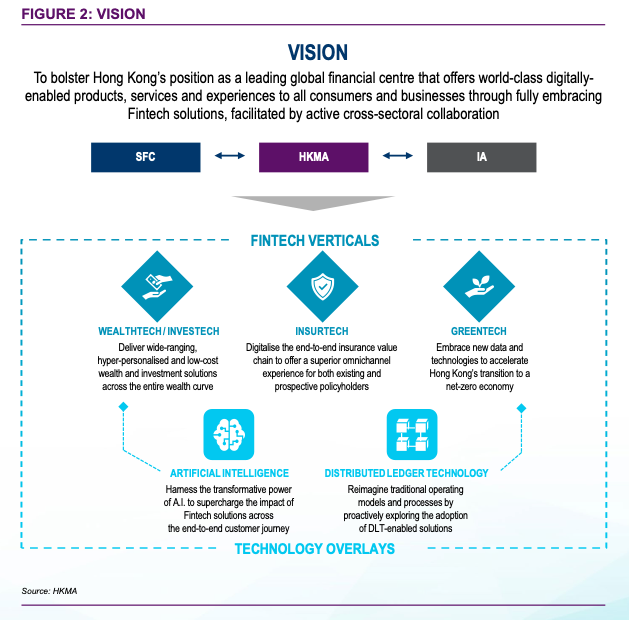

As we step into 2025, Hong Kong’s financial industry is at a critical inflection point. The Hong Kong Monetary Authority (HKMA), alongside the Securities and Futures Commission (SFC) and the Insurance Authority (IA), has charted a Fintech Promotion Roadmap that was unveiled in 2023. This roadmap was not just a policy document—it was a blueprint for transformation. Two years later, its relevance is more pronounced than ever.

For financial institutions, fintech firms, and regulatory technology (Regtech) providers, the question is no longer “Should we adopt fintech?” but rather “How fast can we scale our adoption?” The roadmap set forth an ambitious vision: to position Hong Kong as a leading global financial center powered by cutting-edge financial technology.

At Studio AM, we specialize in Compliance-as-a-Service (CaaS) for financial firms, fintech innovators, and regtech pioneers. Our role is to not only help our clients navigate regulatory landscapes but also to identify opportunities for growth, efficiency, and transformation within these guidelines. This blog post will explore the HKMA’s roadmap from a 2025 perspective, highlighting its impact and what financial industry players should be doing right now to stay ahead.

📖 Reference: HKMA (2023). A BRIDGE TO THE FUTURE: HONG KONG FINTECH PROMOTION ROADMAP. A BRIDGE TO THE FUTURE: HONG KONG FINTECH PROMOTION ROADMAP.

Why is the HKMA Pushing for Greentech?

- In November 2020, the HKMA co-launched the Alliance for Green Commercial Banks with the International Finance Corporation (IFC), aiming to drive sustainable finance innovation.

- In May 2020, the HKMA and the Securities and Futures Commission (SFC) co-initiated the Green and Sustainable Finance Cross-Agency Steering Group (CASG) to align Hong Kong’s regulatory framework with global climate risk management standards.

- In October 2024, the HKMA introduced its Sustainable Finance Action Agenda, outlining clear goals for banks to achieve net zero in operations by 2030 and net zero financed emissions by 2050.

For financial institutions, including banks, fintechs, and regtech firms, the integration of Greentech solutions is not just about meeting HKMA’s compliance requirements—it is about harnessing data-driven insights to mitigate risks, optimize operations, and unlock new growth opportunities.

This blog post distills the key takeaways from the HKMA guide, emphasizing real-world use cases, data challenges, and actionable insights to help financial institutions navigate the evolving compliance landscape.

Key Takeaways from the HKMA’s Fintech Roadmap

1. The PACE Framework: A Call to Action for Financial Institutions

The HKMA introduced the PACE framework to accelerate fintech adoption:

- Propagate: Sharing best practices and knowledge.

- Assess: Understanding emerging technologies and their risks.

- Connect: Bridging fintech users and providers to create synergies.

- Equip: Upskilling financial professionals to leverage fintech effectively.

💡 2025 Insight: By now, financial institutions should have moved beyond awareness and into execution. If your firm is still in the “assessment” phase rather than “activation,” you risk falling behind competitors who have fully integrated fintech into their operations.

2. The Five Fintech Focus Areas: Where Innovation Meets Regulation

The roadmap identified five core areas for fintech development:

Fintech Verticals:

1️⃣ Wealthtech / Investech: Digital wealth management, robo-advisors, and AI-driven investment strategies.

2️⃣ Insurtech: End-to-end digitalization of insurance services, risk assessment via AI, and blockchain-enabled claims processing.

3️⃣ Greentech: Sustainable finance solutions, ESG data analysis, and climate risk assessment tools.

Technology Overlays:

4️⃣ Artificial Intelligence (AI): Generative AI, predictive analytics, fraud detection, and NLP-powered customer service.

5️⃣ Distributed Ledger Technology (DLT): Digital assets, tokenization, cross-border transactions, and decentralized finance (DeFi).

💡 2025 Insight: AI and DLT are no longer optional. If your firm has not yet developed a clear AI strategyor explored tokenization/DLT applications, you are already playing catch-up. Regulations around AI governance and digital assets are tightening—compliance must be built into innovation.

3. The Fintech Adoption Lifecycle: Breaking Through Barriers

The HKMA identified five stages in the Fintech Adoption Lifecycle, each with its own challenges:

1️⃣ Sourcing: Finding the right fintech partners.

2️⃣ Consideration: Evaluating fintech solutions based on security, scalability, and compliance.

3️⃣ Negotiation: Aligning fintech providers with financial institutions’ risk and regulatory requirements.

4️⃣ Onboarding: Overcoming integration hurdles and documentation-heavy processes.

5️⃣ Activation: Ensuring fintech solutions are actually used, not just implemented.

💡 2025 Insight: Many financial firms are still stuck at stages 2-4—they see the value in fintech but struggle with procurement, integration, and compliance bottlenecks. This is where Regtech and CaaS solutionscome in—streamlining these processes through automated compliance, smart contracts, and risk analytics.

How Can Financial Institutions Take Action in 2025?

🔹 For Banks: The “All Banks Go Fintech” initiative from Fintech 2025 should now be fully operational. If your bank is still hesitant on AI-driven risk management, embedded finance, or open banking, you’re behind. Regulatory clarity is here—it’s time to scale.

🔹 For Securities Firms: The SFC has expanded its virtual asset trading platform (VATP) licensing regime. This means tokenization, DLT-based trading, and decentralized finance (DeFi) regulations are now clearer than ever. If you’re not exploring tokenized securities, your competitors are.

🔹 For Insurance Companies: With Open API frameworks in development and AI-driven underwriting becoming mainstream, the insurance sector is rapidly digitalizing. Fraud detection, claims automation, and AI-powered customer engagement are no longer innovations—they’re industry standards.

🔹 For Fintech & Regtech Firms: The HKMA’s push for fintech sandboxes, PoC subsidy schemes, and regulatory engagement means that 2025 is the year to scale. Your solutions should now be market-ready, compliant by design, and optimized for real-world deployment.

Final Thought: 2025 Is Not the Future—It’s Now

Hong Kong’s Fintech Promotion Roadmap was not just a vision for 2023—it was a call to action for 2025.

🚀 If your firm is still in “wait and see” mode, you are already behind. The regulatory environment is now clearer, more structured, and increasingly supportive of fintech adoption. The biggest risk today is not non-compliance—it’s inaction.

At Studio AM, we help financial firms, fintech innovators, and regtech providers navigate compliance without slowing down innovation. Whether it’s AI governance, digital asset compliance, or regulatory onboarding, our CaaS solutions ensure you are not just compliant—but ahead of the curve.

🔍 Want to future-proof your fintech strategy? Let’s talk.

📩 Contact us today to explore how we can help your firm thrive in Hong Kong’s fintech-driven future.