In Search of Clarity? The Digital Asset Model is Being Quietly Perfected in Japan

October 24, 2025

An abstract visual representing global digital asset regulation and frameworks.

Introduction: Beyond the Headlines

In the fast-paced world of digital finance, the spotlight often shines on the regulatory battles and market movements in the United States and Europe. However, as a firm dedicated to providing Compliance-as-a-Service (CaaS) to the financial sector, Studio AM believes it is crucial to look beyond the usual headlines. Japan, a nation often perceived as cautious and traditional, has been quietly, yet diligently, building one of the world's most advanced and practical frameworks for stablecoins and real-world asset (RWA) tokenization. This expanded analysis will delve deeper into Japan’s unique approach, its burgeoning ecosystem of stablecoins and tokenized assets, and how its regulatory philosophy is setting a global benchmark for institutional adoption.

A Masterclass in Regulatory Foresight

While many nations have adopted a reactive stance to the rise of digital assets, Japan has distinguished itself through proactive and comprehensive legislation. The amended Payment Services Act (PSA), which came into effect in June 2023, stands as a landmark piece of regulation, making Japan the first country to establish a clear legal framework for stablecoins.[8]

What truly sets Japan’s approach apart is its nuanced classification system. The PSA defines stablecoins as “Electronic Payment Instruments” and categorizes them into two distinct types:

- Digital Currency-Type Stablecoins: These are backed by cash and cash-equivalents, pegged 1:1 to the Japanese yen, and are treated as electronic payment instruments. This classification allows them to be seamlessly integrated into the existing financial system.

- Crypto Asset-Type Stablecoins: These maintain their value through algorithms and are collateralized by other crypto assets. They are subject to the existing, more stringent regulations for crypto assets.

This clear distinction provides regulatory certainty and allows for a tailored approach to different types of stablecoins. Furthermore, the PSA restricts the issuance of yen-pegged stablecoins to licensed entities, namely banks, fund transfer service providers, and trust companies, all of which are required to maintain 100% reserves. This ensures a high level of consumer protection, mitigates the risk of de-pegging, and builds a foundation of trust in the nascent stablecoin market.

A Flourishing Ecosystem of Yen-Pegged Stablecoins and Digital Currencies

The clarity of Japan’s regulatory environment has not only attracted interest but has also catalyzed a wave of innovation and institutional adoption. Several key initiatives are shaping the future of digital currency in Japan:

The Banking Consortium’s Stablecoin

In a move that underscores the growing institutional confidence in stablecoins, Japan’s three largest banking groups—Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Financial Group, and Mizuho Financial Group—are collaborating on a joint yen-pegged stablecoin.[1] This initiative will leverage MUFG’s Progmat platform, a blockchain-based infrastructure for tokenization, and will establish a shared framework for issuance and transfer. This collaborative, consortium-based approach is a hallmark of Japan’s strategy, fostering interoperability and avoiding the fragmented, competitive landscape seen in other regions.

DCJPY: The Rise of Tokenized Deposits

Beyond traditional stablecoins, Japan is also pioneering the concept of tokenized deposits with the DCJPY (Digital Currency JPY) initiative. A prime example is Japan Post Bank, which plans to launch a digital yen by the end of fiscal year 2026, representing a staggering $1.36 trillion in deposits.[6] Built on the DeCurret DCP blockchain, DCJPY will allow users to link their savings accounts to a digital currency account, with each unit valued at 1 yen. This model, where bank deposits themselves are tokenized, offers a different risk profile and regulatory treatment compared to stablecoins issued by non-bank entities.

JPYC: The First Non-Bank Stablecoin

The approval of JPYC as the first yen-denominated stablecoin issued by a non-bank entity marks another significant milestone.[5] JPYC, a fintech company, has registered as a money transfer business with the Financial Services Agency (FSA), paving the way for the legal issuance of its yen-pegged stablecoin. Backed by liquid assets such as bank deposits and government bonds, JPYC’s approval demonstrates the viability of Japan’s regulatory framework for a diverse range of issuers.

Foreign Stablecoins Enter the Fray

Japan’s regulatory clarity has also attracted foreign players. In a significant development, Ripple has partnered with SBI Holdings to distribute its US dollar-pegged stablecoin, RLUSD, in Japan, with a planned launch in the first quarter of 2026.[7] This partnership, which leverages SBI’s licensed status, will be the first major instance of a US dollar-pegged stablecoin being legally distributed in Japan, further integrating the country into the global digital asset economy.

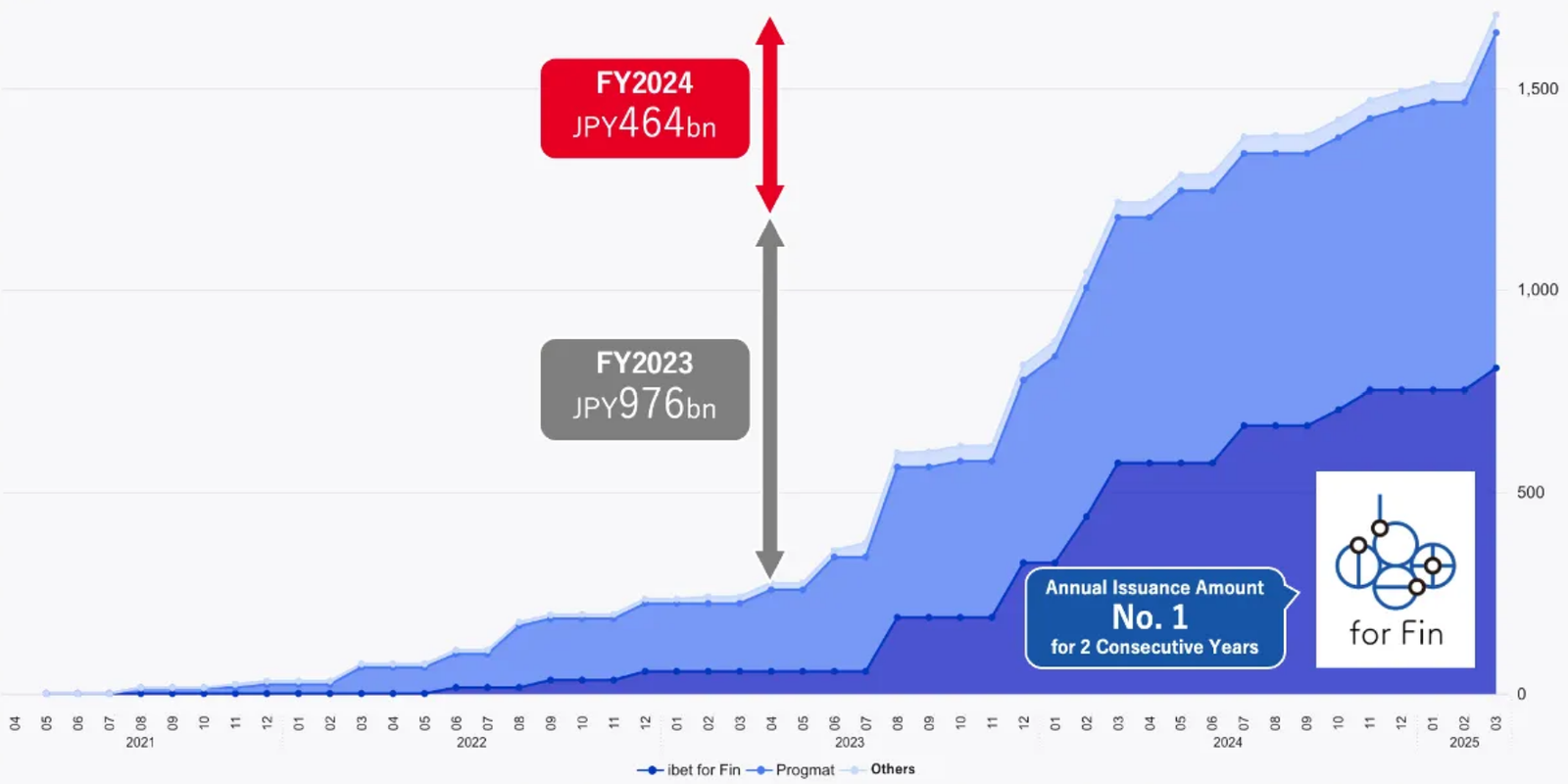

Leading the Charge in RWA Tokenization

Japan’s leadership in digital assets extends beyond stablecoins to the rapidly growing field of RWA tokenization. The country’s security token market has experienced explosive growth, with a cumulative issuance of JPY 168.2 billion by the end of fiscal year 2024.[4] This boom is a direct result of a clear legal framework that provides investors with the legal certainty and confidence needed to participate in this innovative market.

Source: Boostry, Total Issuance in FY2024.

Real estate has emerged as a particularly popular asset class for tokenization. A prime example is GATES Inc.’s ambitious plan to tokenize $75 million worth of Tokyo property on the Oasys blockchain, with the ultimate goal of tokenizing up to $200 billion in assets.[3] This initiative aims to fractionalize ownership and make it easier for foreign investors to access Japan’s lucrative real estate market.

The success of early projects is further fueling the market’s growth. One real estate security token, for instance, delivered an impressive 23.6% internal rate of return (IRR) upon redemption, showcasing the potential for significant returns in this space.[4] The market is also diversifying beyond real estate, with the tokenization of assets such as film funds and solar power facilities, demonstrating the broad applicability of this technology.

A Comparative Perspective: Why Japan’s Model Stands Out

To fully appreciate the significance of Japan’s approach, it is essential to compare it with the regulatory landscapes of other major financial hubs.

| Region | Regulatory Framework | Key Characteristics |

|---|---|---|

| Japan | Payment Services Act (amended June 2023) | - Proactive and comprehensive - Clear classification system - Issuer restrictions (banks, trusts, money transfer companies) - 100% reserve requirement |

| United States | GENIUS Act (July 2025) | - Focus on dollar hegemony - 100% reserve requirement in USD and treasuries - Ban on algorithmic stablecoins - High barriers to entry for smaller issuers |

| European Union | MiCA (fully implemented December 2024) | - Comprehensive framework for all crypto assets - 30% of reserves must be held in EU banks - High compliance costs, potentially stifling innovation |

| Singapore | SCS Framework (August 2023) | - Pragmatic and risk-based approach - Only G10 currencies and SGD allowed - Seen as a practical alternative to a retail CBDC |

The Road Ahead: Lessons from Japan’s Quiet Revolution

As the world moves towards a more tokenized future, Japan’s experience offers invaluable lessons for financial institutions, regulators, and compliance professionals. The Japanese model of proactive regulation, institutional collaboration, and a focus on real-world use cases provides a blueprint for building a safe, sustainable, and innovative digital asset ecosystem.

For firms like Studio AM, Japan’s journey underscores the critical importance of staying ahead of the regulatory curve and understanding the nuances of different jurisdictional approaches. As the digital asset landscape continues to evolve, the lessons from Japan’s quiet revolution will undoubtedly resonate globally, shaping the future of finance for years to come.

Sources

- Sandor, K. (2025, October 17). Japan’s Top Banks Plan Joint Stablecoin Launch: Nikkei. CoinDesk. Retrieved from https://www.coindesk.com/business/2025/10/17/japan-s-top-banks-plan-joint-stablecoin-launch-nikkei

- Law.asia. (2025, May 14). Japan’s crypto-asset, stablecoin and security token regulations. Retrieved from https://law.asia/japan-crypto-stablecoin-regulations-2025/

- Sandor, K. (2025, July 10). RWA News: Japan's GATES to Tokenize $75M Tokyo Real Estate on Oasys Network. CoinDesk. Retrieved from https://www.coindesk.com/business/2025/07/10/japanese-real-estate-firm-gates-to-tokenize-75m-in-tokyo-property-on-oasys-blockchain

- Boostry. (2025, April 1). Japan Security Token Market Report (FY2024). Retrieved from https://boostry.co.jp/blog/st-market-fy2024e

- Crawley, J. (2025, August 18). Stablecoin News: Japan's Regulator to Approve First Yen-Denominated Token, Issued by JPYC. CoinDesk. Retrieved from https://www.coindesk.com/policy/2025/08/18/japan-s-financial-regulator-to-approve-first-yen-denominated-stablecoin-report

- Reuters. (2025, September 1). Japan Post Bank to launch digital yen in 2026. Retrieved from https://www.reuters.com/business/media-telecom/japan-post-bank-launch-digital-yen-2026-2025-09-01/

- SBI Group. (2025, August 22). Ripple and SBI Group Sign a Memorandum of Understanding for the Distribution of RLUSD in Japan. Retrieved from https://www.sbigroup.co.jp/english/news/pdf/2025/0822_d_en.pdf

- Sooho.io. (2025, July 21). US vs EU vs Asia: Stablecoin Regulations. Retrieved from https://www.sooho.io/en/articles/stablecoin-regulations