Navigating Hong Kong’s IADS Revolution: Compliance Insights and Strategic Opportunities for Fintech Innovators

The Dawn of Open Banking in Hong Kong

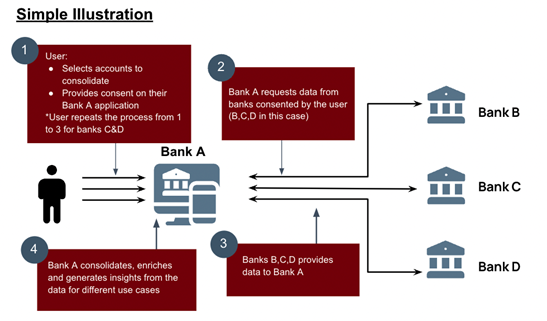

The Hong Kong Monetary Authority (HKMA) is spearheading a transformative shift in financial services with its Interbank Account Data Sharing (IADS) initiative. As a cornerstone of Hong Kong’s Open Banking framework, IADS empowers customers to securely share their banking data across institutions, unlocking unprecedented opportunities for innovation in lending, financial management, and compliance. For fintech and regtech firms, this evolution demands a proactive approach to compliance while capitalizing on emerging opportunities.

(Figure from HKMA)

1. IADS at a Glance: What Compliance Leaders Need to Know

- Core Principles:

IADS hinges on data ownership (customers control their data), transparency, security (aligned with ISO 27001 and OAuth 2.0 standards), and interoperability. Participating banks must implement robust APIs and consent management systems. - Current Scope:

- 28 Participating Banks (e.g., HSBC, ZA Bank, DBS) are piloting use cases like consolidated financial dashboards, SME loan automation, and AI-driven KYC.

- Data Shared: Deposit account balances, transactions, and statuses (corporate, SME, retail).

| Current 28 IADS Participating Banks Under the Pilot | ||

| Airstar Bank Limited | CMB Wing Lung Bank Limited | Mox Bank Limited |

| Ant Bank (Hong Kong) Limited | Dah Sing Bank, Limited | Nanyang Commercial Bank, Limited |

| Bank of China (Hong Kong) Limited | DBS Bank (Hong Kong) Limited | OCBC Bank (Hong Kong) Limited |

| Bank of Communications (Hong Kong) Limited | Fubon Bank (Hong Kong) Limited | PAO Bank Limited |

| The Bank of East Asia, Limited | Fusion Bank Limited | Public Bank (Hong Kong) Limited |

| China CITIC Bank International Limited | Hang Seng Bank, Limited | Shanghai Commercial Bank Limited |

| China Construction Bank (Asia) Corporation Limited | The Hongkong and Shanghai Banking Corporation Limited | Standard Chartered Bank (Hong Kong) Limited |

| Chiyu Banking Corporation Limited | Industrial and Commercial Bank of China (Asia) Limited | WeLab Bank Limited |

| Chong Hing Bank Limited | Livi Bank Limited | ZA Bank Limited |

| Citibank (Hong Kong) Limited | ||

- Regulatory Backbone:

Built on HKMA’s Phase III Open API Standards, emphasizing technical rigor, customer authentication, and cybersecurity.

Compliance Takeaway:

IADS mandates rigorous adherence to data governance frameworks. Fintechs must ensure APIs meet HKMA’s technical and security benchmarks while embedding consent workflows that comply with evolving privacy laws.

| Phase | Open API functions | Examples | Delivery time |

| I | Product and service information: “Read-only”information offered by banks on details of their productsand services; | Deposit rates, credit card offerings, service charges and other public information | By the end of January 2019 |

| II | Subscription and new applications for product/service | New applications for credit cards, loans and other products | By the end of October 2019 |

| III | Account information (Related to IADS) | Account balance, credit card outstanding balance, transaction records, credit limit change and others | The initial set of API functions, which includes deposit account information only and online merchant payments, is being implemented gradually, with over 90% of banks having achieved full implementation. Phase 3 is currently being launched through IADS |

| IV | Transactions | Payment and transfers |

2. Compliance Challenges: Navigating the New Frontier

- Consent Management:

Customers must explicitly authorize data sharing across banks, with revocation rights. Compliance teams must design auditable consent trails and ensure real-time updates to data access permissions. - Cross-Institution Security:

With data flowing between multiple banks, vulnerabilities multiply. Solutions like tokenization and TLS 1.3 encryption are non-negotiable. - Regulatory Harmonization:

Unlike the EU’s PSD2 (which includes third-party providers), IADS currently limits data consumers to banks. However, HKMA’s roadmap signals eventual expansion—align strategies with future-proof standards.

Case in Point:

Dah Sing Bank’s IADS-powered KYC process slashes SME onboarding from weeks to hours by validating account data across banks. Compliance teams enabled this by integrating OAuth 2.0 and OpenID Connect protocols.

3. Strategic Opportunities for Fintechs and Regtechs

- Lending Innovation:

- AI-Driven Credit Scoring: Leverage real-time cash flow data to serve underserved segments (e.g., freelancers, SMEs). ZA Bank reduced loan approvals to 3 minutes using IADS.

- Fraud Mitigation: Cross-verify applicant data against multiple banks to detect anomalies.

- Financial Management Tools:

- Hyper-Personalized PFM: Platforms like Citi’s Wealth 360 aggregate data across banks to offer carbon footprint tracking and savings insights.

- SME Cash Flow Analytics: Integrate IADS data into tools that predict liquidity gaps or automate invoicing.

- KYC 2.0:

Replace manual document checks with automated identity verification using trusted interbank data.

Compliance Catalyst:

Regtechs can develop API monitoring tools to audit data flows, flagging breaches in real time. Studio AM’s expertise in cross-jurisdictional compliance (e.g., aligning IADS with Singapore’s MyInfo or EU’s eIDAS) positions clients to scale securely.

(From left) Ms Carmen Chu, Executive Director (Banking Supervision) of the Hong Kong Monetary Authority; Ms Elsie Gung, Deputy General Manager (Business Banking Segment) of Bank of China (Hong Kong) Limited; Mr Benson Cheung, Director of Yat Fung Telecom (Group) Limited; Mr Eric Fan, Senior Vice President, Head of Digital Transformation Division of Shanghai Commercial Bank Limited; and Mr Kent Chow, Chief Financial Officer of Ideal Wisdom Enterprise Limited, share their experiences in the practical applications of IADS for SMEs in a panel discussion.

(Picture from HKMA Showroom Day)

4. The AI Imperative: Fueling Innovation with Open Data

IADS is a goldmine for AI development, addressing the #1 barrier to AI adoption in banking: insufficient data.

- Training Richer Models:

Banks gain holistic views of customer behavior (e.g., 3+ accounts per user), enabling predictive analytics for personalized products. - Agentic AI:

Autonomous systems can use IADS data to execute tasks like dynamic risk assessments or fraud detection without human intervention.

Compliance Edge:

AI models trained on IADS data require bias audits and explainability frameworks to meet HKMA’s ethical AI guidelines. Studio AM’s AI governance solutions ensure transparency and regulatory alignment.

5. The Future of IADS: Preparing for Expansion

HKMA plans to broaden IADS to include credit cards, insurance, and MPF providers by 2026. Compliance teams must:

- Anticipate cross-sector data sharing rules.

- Prepare for third-party fintech inclusion, mirroring global trends.

- Invest in scalable API infrastructures that adapt to HKMA’s evolving standards.

Conclusion: Turning Compliance into Competitive Advantage

ADS isn’t just a regulatory mandate—it’s a launchpad for innovation. Fintechs that master its compliance demands will lead in:

- Customer Trust: Transparent data practices attract users wary of breaches.

- Market Agility: Early adopters of IADS-driven AI tools will dominate niches like SME lending and PFM.

- Global Readiness: Align with frameworks like Project Aperta (BIS’s cross-border Open Finance initiative) to expand beyond Hong Kong.

Studio AM’s Role:

We specialize in IADS-ready compliance strategies, from API security audits to consent management systems. Let us help you transform regulatory complexity into your strongest differentiator.

🔍 Further Reading & Resources

For those looking to explore these topics in more depth, check out these key regulatory resources:

📌 HKMA Open API Framework

📌 HKMA IADS Initiative

📌 EU PSD2 & Open Banking

📌 UK Open Banking

Stay Ahead of the Curve with Studio AM

Ready to harness IADS for innovation? Contact Studio AM to design a compliance roadmap that turns Open Banking challenges into growth opportunities.