SFC 2024 Market Reflections: A Turning Point or a Temporary Rebound?

Introduction: A Year of Contrasts

The past year has been one of contrasts and contradictions in global and Hong Kong markets. Optimism returned to equities as major central banks shifted away from aggressive rate hikes, yet concerns over geopolitical tensions, economic slowdowns, and structural vulnerabilities remained unresolved.

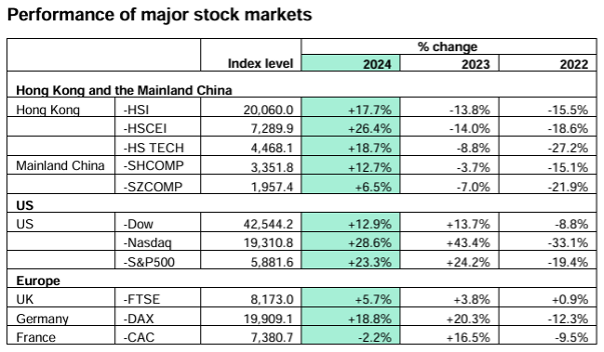

In Hong Kong, the Hang Seng Index (HSI) staged a strong comeback, rising 17.7%, but whether this rebound signals a long-term recovery or a temporary, policy-driven rally remains an open question. Mainland China’s economic growth slowed to 4.6% in Q3 2024, missing its 5% target, while the RMB weakened 2.7% against the USD, raising concerns about capital outflows and investor confidence.

At the same time, cross-border capital flows surged, with Stock Connect’s Southbound trading reaching an all-time high of HK$807.9 billion, now accounting for 18.3% of Hong Kong’s total market turnover—a stark shift from when the program first launched in 2014, making up just 0.7% of turnover.

These numbers paint a picture of a market buoyed by liquidity and policy support, but one that may still be vulnerable to external shocks. As 2025 approaches, financial institutions, asset managers, and compliance professionals must look beyond the headline figures to assess whether these trends are sustainable or if deeper risks lie beneath the surface.

📖 Ref: SFC, 2025. Research Paper No.76: A Review of the Global and Local Securities Markets in 2024. https://www.sfc.hk/-/media/EN/files/SOM/RS-Paper/RS-paper-76.pdf?rev=91bde7a550034a7896f48c2ca38ce10a&hash=744C45C06235E518BBDDFBAE370F3AFD

📌 Global Markets: Liquidity-Driven Optimism or the Start of a Bubble?

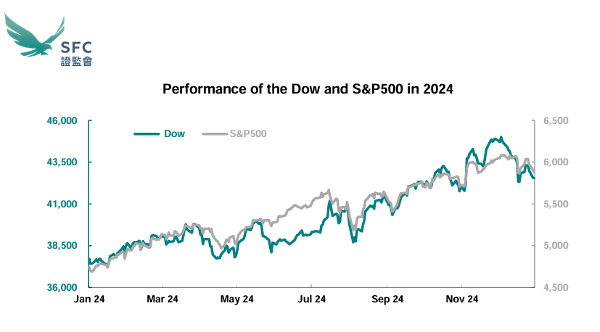

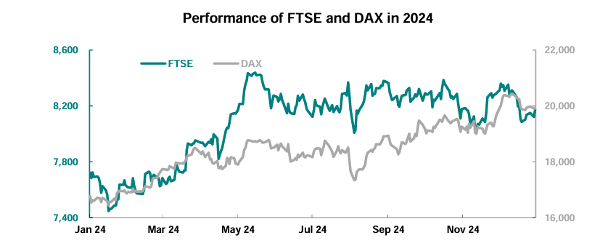

The Federal Reserve’s three 25-basis-point rate cuts in the latter half of 2024 signaled a decisive shift away from the tightening cycle of the previous two years. The European Central Bank followed suit with four rate cuts, collectively easing 100 basis points. Unsurprisingly, risk assets rallied.

- 🔹 The Nasdaq soared 28.6%, powered by AI-driven enthusiasm and speculative tech bets.

- 🔹 The S&P 500 climbed 23.3%, breaking multiple all-time highs.

- 🔹 Even the Dow, traditionally a more conservative index, gained 12.9%, reflecting broad-based investor optimism.

Yet, this liquidity-fueled rally raises critical concerns about valuation sustainability. The US economy expanded 3.1% in Q3, but wage growth has slowed, and corporate earnings are increasingly reliant on stock buybacks rather than organic revenue expansion. Debt levels in advanced economies remain near record highs, and if inflation unexpectedly resurfaces, central banks may be forced into an abrupt policy reversal, shaking market confidence.

For financial institutions, this environment presents both opportunities and risks. On one hand, lower interest rates have eased funding conditions, benefiting lenders, fintech platforms, and growth-focused companies. On the other hand, regulators may soon tighten oversight on speculative investment flows and AI-driven trading strategies, particularly as market volatility remains a latent risk factor.

💡 Hong Kong’s Equity Market: A Sustainable Recovery?

Hong Kong’s market outperformed most global peers in 2024, with the Hang Seng TECH Index rising 18.7%, fueled by renewed interest in Chinese technology stocks. Yet, the timing of this rebound suggests policy intervention played a significant role.

Earlier in the year, the China Securities Regulatory Commission (CSRC) introduced five key capital market cooperation measures, aimed at strengthening investor confidence in Hong Kong-listed Mainland enterprises. Additionally, Beijing rolled out a 50-basis-point reserve requirement ratio (RRR) cut, alongside targeted stimulus measures for the property sector.

Despite these supportive policies, underlying economic challenges remain:

- ✅ Mainland China’s GDP growth (4.6% in Q3) fell short of the government’s 5% target, raising concerns over long-term economic momentum.

- ✅ The RMB depreciated 2.7% against the USD, reflecting investor caution and potential capital outflows.

- ✅ Global funds remain underweight on Chinese equities, with institutional investors still seeking clarity on regulatory stability and corporate governance reforms.

If this rebound is primarily policy-driven rather than fundamentally supported, Hong Kong’s market could face renewed volatility should stimulus measures lose their effectiveness.

For compliance teams, this shifting landscape means closer monitoring of regulatory changes, cross-border capital flows, and reporting requirements for institutional investors participating in Stock Connect. The increasing integration between Mainland and Hong Kong markets also suggests that AML and risk management frameworks will need to evolve, particularly as authorities seek to prevent capital flight and speculative activity.

🌎 Stock Connect: A Growing Systemic Force in Hong Kong’s Market

Perhaps one of the most significant—and underappreciated—trends of 2024 was the explosive growth of Stock Connect trading.

- 🔹 Southbound net inflows reached HK$807.9 billion, an all-time high.

- 🔹 Southbound trading accounted for 18.3% of total market turnover, the highest proportion ever recorded.

This sharp increase in Mainland investor participation raises important structural questions. If Hong Kong’s market is becoming increasingly reliant on Mainland liquidity, what happens if those flows reverse or slow down?

Additionally, given the sheer size of these flows, regulatory scrutiny may intensify. Authorities could introduce new disclosure requirements for institutional investors participating in Stock Connect, particularly as concerns grow over potential capital control evasions or excessive speculative behavior.

For financial firms, this means greater complexity in compliance reporting, risk assessment, and trade surveillance—as well as potential opportunities for regtech solutions to streamline these processes.

🔥 Short-Selling and Derivatives: A Measure of Market Confidence?

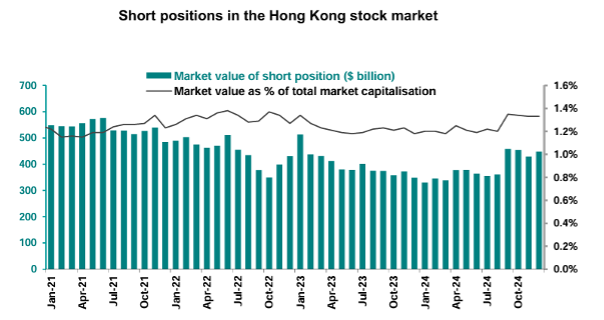

While overall trading activity surged, short-selling as a proportion of market turnover actually declined, averaging 15.6% in 2024 compared to 17.0% in 2023. This suggests that investor sentiment has improved, with fewer traders betting on market declines.

At the same time, the notional value of OTC equity derivatives linked to Hong Kong stocks remained steady at HK$1.3 trillion, indicating no immediate signs of systemic risk accumulation.

However, history suggests that shifts in short interest can lag behind broader market movements. If sentiment deteriorates—due to policy shifts, unexpected rate hikes, or geopolitical shocks—short positioning could rise sharply, adding to market volatility.

Regulators may continue to monitor short-selling activity closely, particularly in sectors that are highly sensitive to policy changes. Compliance teams should ensure that reporting frameworks remain robust, particularly as market conditions evolve.

🎯 Looking Ahead: Key Themes for 2025

As we move into 2025, financial institutions, investors, and regulators will need to navigate an increasingly complex and interconnected market environment. Some key themes to watch include:

- Will monetary easing continue, or could inflationary pressures force a policy reversal?

- How will Hong Kong’s market react if Mainland stimulus measures fade?

- Will Stock Connect continue to drive liquidity, or could regulatory intervention slow its growth?

- How will compliance and risk management frameworks evolve as cross-border integration deepens?

For financial firms, the ability to adapt to these uncertainties, enhance regulatory compliance, and leverage technology for risk management will be critical in navigating the next phase of market developments.

🔍 Would you like to explore strategies for optimizing compliance in this evolving landscape? Let’s continue the conversation.