This Is What Happens When PI Screening Fails: 12 Years of Misclassification

November 14, 2025

Introduction

For the second time in four years, UBS AG is writing a seven-figure check to Hong Kong’s Securities and Futures Commission (SFC) for the exact same category of failure: wrongly classifying clients as Professional Investors (PIs) and providing them services they weren’t eligible for[1] [2]. The latest $8 million penalty isn’t just another regulatory slap on the wrist; it’s a glaring indictment of a corporate culture where remediation is performative and controls are merely an illusion.

The core failure isn’t that an automated system misinterpreted a rule for 12 years. It’s that the bank’s governance structure allowed a known, previously fined risk to fester and re-emerge.

This wasn’t a new vulnerability; it was a ghost from the recent past that the firm failed to exorcise.

For Chief Compliance Officers and Heads of Risk, the burning question isn’t just “Why did this happen?” but “How did a multi-million-dollar fix in 2021 lead directly to another multi-million-dollar fine in 2025?”

This was not a simple error. It was a cascade of specific, identifiable breakdowns that reveal a deeply flawed approach to risk management.

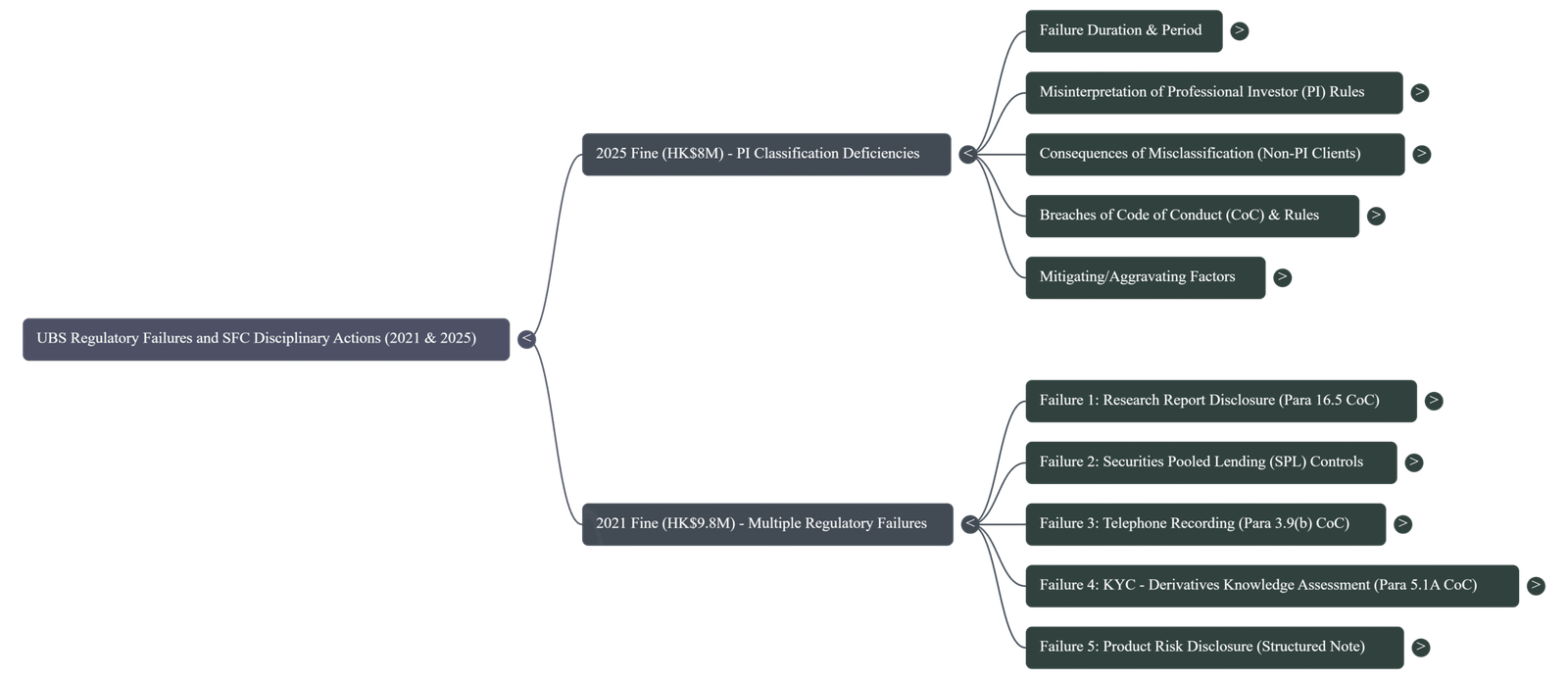

The SFC’s disciplinary actions from both 2025 and 2021 provide a granular roadmap of the failure.

1. The Technology Trap: Precision Error at Industrial Scale

The 2025 failure originated in 2009 with a fatal, codified misinterpretation of the PI Rules within UBS’s automated classification system.

The error wasn’t vague; it was surgically precise. The system failed to distinguish between different types of joint accounts:

- Non-Associate Joint Accounts: The system incorrectly assumed that if a joint account held over HK$8 million, it was a PI account. It failed to apply the rule that each non-associated individual on the account must independently meet the HK$8 million threshold.

- Parent-Child Joint Accounts: The system failed to recognize that while a child is an “associate” of a parent, the reverse is not true. It wrongly classified accounts where the child’s eligibility was not independently verified.

This wasn’t a minor glitch. A look-back review found 560 misclassified accounts, comprising 135 Non-Associate and 425 Parent-Child accounts.

This led to 9,190 unauthorized Securities Pooled Lending (SPL) transactions and 500 transactions in PI-Restricted Products like accumulators and Chapter 37 bonds[1]. The automation, designed for efficiency, became a high-speed engine for non-compliance, creating a systemic vulnerability that went undetected for over a decade.

2. The Governance Breakdown: A Failure of Corporate Memory

This is where the story turns from a control failure to a governance catastrophe.

The 2025 fine is a direct echo of the 2021 enforcement action, which carried a HK$9.8 million penalty for UBS AG.

A core finding in that case was the firm’s failure to prevent 2,263 non-PI clients from subscribing to the SPL service, with 91 of them conducting 913 transactions between 2012 and 2019[2].

| Enforcement Action | Fine (UBS AG) | Specific PI-Related Failure |

|---|---|---|

| October 2025 | HK$8 million | Automated misclassification of 560 joint accounts, leading to unauthorized SPL service and sale of PI-restricted products. |

| August 2021 | HK$9.8 million | Failure to supervise advisors, resulting in 913 SPL transactions with 91 non-PI clients. Also cited for 4 other major control failures. |

This recurrence proves the 2021 remediation was a failure. It was likely a superficial fix that addressed the symptom (e.g., retraining advisors) but missed the disease: the flawed automation logic at the heart of the classification process.

A governance structure with any real teeth would have mandated a front-to-back review of the entire PI classification workflow after the first fine, including the automated systems.

The failure to do so demonstrates a lack of corporate memory and a profound breakdown in the feedback loop between regulatory sanction and meaningful change.

3. The Culture Chasm: When “Good Enough” Is a Recipe for Disaster

This pattern of repeated, un-remediated failures is symptomatic of a deep-seated cultural problem.

It points to an environment where compliance is a cost center and risk management is about plausible deniability.

The 2021 enforcement action against UBS was not a single-issue event; it detailed five separate, significant control failures, including breakdowns in telephone recording and derivatives knowledge assessment[2]. One of the most telling details was the failure to disclose a “stop loss event” feature on a structured note, an omission a team member noticed but dismissed as insignificant[2].

This mindset—where a control gap is noted but not escalated—is the essence of a broken culture.

It’s a culture where employees are not empowered or incentivized to raise red flags, and where the commercial imperative silently overrides the control mandate.

When a firm is cited for five distinct failures in one year and then fined again four years later for a repeat offense, it’s no longer about isolated mistakes. It’s about a culture that tolerates mediocrity in its control functions.

The Studio AM Takeaway: From Generic Platitudes to Concrete Controls

The UBS case is a masterclass in how not to manage compliance risk.

The lesson for the rest of the industry is to move beyond the generic advice of “enhancing due diligence” and implement specific, robust controls that can prevent a similar catastrophe.

Before your next audit committee meeting, ask your team for proof—not promises—that you have these concrete mechanisms in place:

Action: Demand a map of all automated compliance “decision gates” and a corresponding schedule for human-in-the-loop validation.

Action: Ask for the sign-off sheet for the last major regulatory change that impacted your firm’s systems.

Action: Select the top three regulatory or internal audit findings from the last 18 months and commission an independent review of the remediation’s long-term effectiveness.

Action: Propose a specific, measurable metric for control integrity to be included in the performance scorecards for all senior managing directors.

UBS’s repeated failures demonstrate that good intentions and superficial fixes are worthless.

The only true measure of a strong compliance culture is the implementation of specific, verifiable, and durable controls.

Anything less is just waiting for the next fine.

References

[1] Securities and Futures Commission. (2025, October 20). SFC reprimands and fines UBS AG $8 million for professional investor misclassification. https://apps.sfc.hk/edistributionWeb/gateway/EN/news-and-announcements/news/doc?refNo=25PR167

[2] Securities and Futures Commission. (2021, August 3). SFC reprimands and fines UBS AG and UBS Securities Asia Limited $11.55 million for regulatory breaches. https://apps.sfc.hk/edistributionWeb/api/news/list-content?refNo=21PR81&lang=EN