The Future of Smart Contracts in Financial Compliance: Insights from ASIFMA’s 2024 Primer

🚀 The Compliance Revolution through Smart Contracts

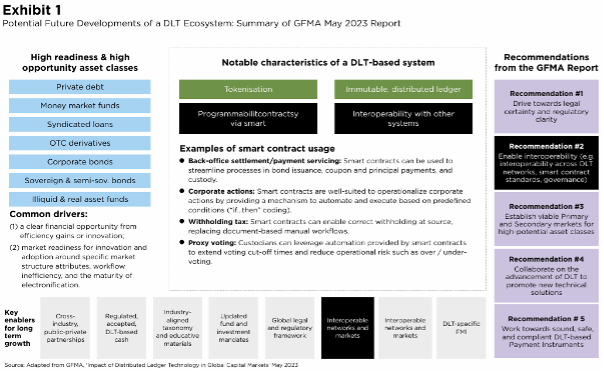

The financial industry is undergoing a fundamental transformation, driven by the increasing adoption of smart contracts—self-executing agreements that automate compliance, transactions, and risk management. The 2024 ASIFMA Smart Contract Primer provides an in-depth look at how financial institutions can integrate this technology while remaining compliant with evolving regulatory frameworks.

For compliance-as-a-service (CaaS) providers like Studio AM, this presents an urgent opportunity: to bridge the gap between regulatory expectations and technological capabilities, ensuring that financial firms implement smart contracts responsibly and effectively.

This blog post distills the key takeaways from ASIFMA’s report and extracts two critical use cases that highlight how smart contracts can redefine compliance in financial markets.

📖 Ref: ASIFMA, (2024). An Initial Overview of Smart Contract. https://www.asifma.org/wp-content/uploads/2024/10/gfma-gdf-smart-contract-primer-report-2024.pdf

📌 Key Insights: How Smart Contracts Will Shape Financial Compliance

- ✅ Interoperability & Standardization Are Non-NegotiableThe financial industry cannot fully leverage smart contracts without standardized frameworks, ensuring that different platforms, jurisdictions, and institutions can integrate seamlessly. Without common standards, smart contract inefficiencies could create regulatory fragmentation rather than efficiency.

- ✅ Regulators Are Not Introducing Special Regimes—They Are Applying Existing Laws

A crucial takeaway is that regulators see no need for special regimes to oversee smart contracts. Instead, they assert that existing legal, operational, and financial risk management frameworks are already sufficient to govern smart contract deployment. This means firms must understand how to map smart contract risks to existing compliance requirements rather than expecting entirely new regulatory structures. - ✅ Operational Risk Must Be Addressed Through Best Practices

While smart contracts automate and reduce human intervention, they introduce new risks—such as code vulnerabilities, execution errors, and governance ambiguities. The industry is moving toward best practices that require:- Independent audits of smart contract code for robustness and security.

- Clear incident response mechanisms in case of unforeseen failures.

- Defined legal enforceability structures, ensuring contracts remain legally binding even when automated.

- ✅ Liability, Jurisdiction, and Dispute Resolution Must Be Predefined

The enforceability of smart contracts depends significantly on pre-agreed contractual terms governing liability, jurisdiction, and dispute resolution. Financial institutions must ensure that smart contracts are structured to align with cross-border regulatory requirements, reducing the risks of legal uncertainty.

📌 Use Case #1: Smart Contracts in Regulatory Reporting & Compliance Automation

The Challenge

Regulatory reporting is one of the most burdensome compliance obligations for financial institutions. Firms must compile, validate, and submit reports to multiple regulators across different jurisdictions. The current system is:

- Manual and prone to errors, increasing the risk of regulatory fines.

- Inefficient, requiring redundant data reconciliation across multiple systems.

- Slow, leading to compliance delays that expose firms to regulatory risk.

The Smart Contract Solution

Smart contracts can automate regulatory reporting by embedding compliance logic directly into financial transactions. Here’s how it works:

- When a trade is executed, a smart contract automatically records transaction details on a distributed ledger.

- The contract then validates the transaction against regulatory requirements in real time.

- If the transaction meets compliance standards, it auto-generates and submits reports to regulatory bodies without human intervention.

- If an anomaly is detected (e.g., exceeding trading limits, AML red flags), the contract alerts compliance teams instantly for review.

🔥 Why This Matters

Imagine a global fintech firm that operates in multiple jurisdictions. Today, it must manually comply with MiFID II in the EU, Dodd-Frank in the US, and MAS regulations in Singapore—all of which have different requirements. A smart contract-based regulatory reporting system would:

- Instantly adapt to multi-jurisdictional compliance rules, reducing the risk of non-compliance.

- Eliminate reporting inefficiencies, freeing compliance teams to focus on higher-value risk management activities.

- Reduce regulatory fines, as errors and omissions in reporting would be minimized.

For CaaS providers, this use case presents a major opportunity: offering smart contract-based compliance automation solutions that reduce operational burdens for financial firms.

📌 Use Case #2: Smart Contracts for Post-Trade Settlement & Market Infrastructure Compliance

The Challenge

Post-trade settlement remains one of the most inefficient aspects of financial markets. Clearing and settlement processes are:

- Heavily intermediated, requiring coordination between custodians, clearinghouses, and counterparties.

- Time-consuming, leading to liquidity lock-ups and capital inefficiencies.

- Prone to reconciliation issues, creating counterparty risks and settlement failures.

From a compliance perspective, post-trade processes must also adhere to:

- Liquidity coverage ratio (LCR) requirements under Basel III.

- Anti-money laundering (AML) and counter-terrorism financing (CTF) laws.

- Sanctions screening obligations, ensuring transactions do not involve restricted entities.

The Smart Contract Solution

A smart contract-driven post-trade system eliminates inefficiencies by:

- Automating settlement instructions immediately upon trade execution.

- Embedding AML, sanctions, and compliance checks directly into the settlement process, ensuring that only compliant transactions are executed.

- Triggering real-time collateral adjustments, ensuring alignment with liquidity requirements.

- Reducing counterparty risk through instant delivery-versus-payment (DvP) mechanisms, eliminating settlement delays.

🔥Why This Matters

For financial institutions, integrating smart contracts into post-trade workflows would:

- Reduce settlement times from T+2 or T+1 to near-instantaneous execution.

- Ensure full regulatory compliance at every stage of the settlement process.

- Improve capital efficiency, allowing firms to deploy liquidity more strategically.

For CaaS providers, this presents an opportunity to develop compliance-integrated smart contract solutions that help financial firms:

- Manage regulatory reporting obligations in real-time.

- Enhance AML and risk monitoring within post-trade processes.

- Reduce operational costs associated with manual compliance checks.

🎯 Final Thoughts: The Role of CaaS in Smart Contract Adoption

The 2024 ASIFMA Smart Contract Primer reinforces a critical reality: smart contracts are not just a technological innovation; they are a regulatory imperative.

For CaaS providers like Studio AM, this presents a unique opportunity to:

- ✅Guide financial firms through the legal and regulatory complexities of smart contract deployment.

- ✅Offer smart contract auditing and compliance integration services to mitigate operational risks.

- ✅Develop tailored compliance automation solutions that leverage smart contracts for real-time regulatory reporting and post-trade compliance.

As smart contracts reshape financial compliance, the firms that proactively adapt will gain a competitive edge. The question is no longer if compliance teams should engage with smart contracts—but rather how quickly they can integrate this technology to drive efficiency and regulatory alignment.

For financial firms looking to future-proof their compliance strategies, now is the time to start building the smart contract infrastructure that will define the next era of financial regulation.

🚨 How Studio AM Can Help

At Studio AM, we specialize in CaaS solutions that bridge the gap between compliance and innovation. Whether you’re exploring smart contract compliance frameworks, regulatory automation, or risk mitigation strategies, we provide the expertise to help your firm navigate the evolving landscape.

📩 Let’s build the future of compliance together. Reach out to us today to discuss how smart contracts can enhance your regulatory strategy. 🚀