AI Audits & Crypto Crackdown? Decoding MAS's Latest Enforcement Playbook

The Writing’s on the Wall: MAS Signals a Compliance Shake-Up

The Monetary Authority of Singapore (MAS) isn’t just watching the financial markets; it’s actively reshaping compliance expectations with cutting-edge tools and significant penalties. The latest MAS Enforcement Report (July 2023–Dec 2024) is more than a summary of past actions – it’s a clear roadmap for the future, signalling a major shift towards technology-driven surveillance and enforcement. With hefty fines levied and new investigative powers flexed, the message for Singapore’s FIs, fintechs, and regtechs is stark: adapt or face the consequences. At Studio AM, we’re dissecting this critical report to help you anticipate what’s next.

📖 Ref: MAS (2025) MAS Enforcement Report 2023/2024

The $11 Million Message: Where MAS Focused its Firepower

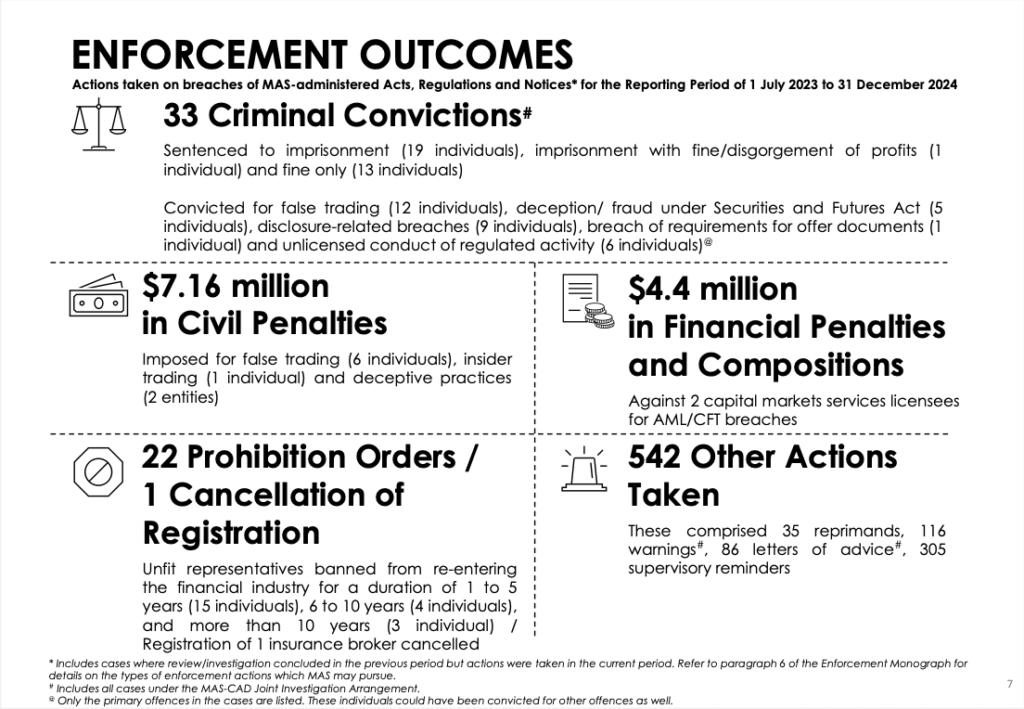

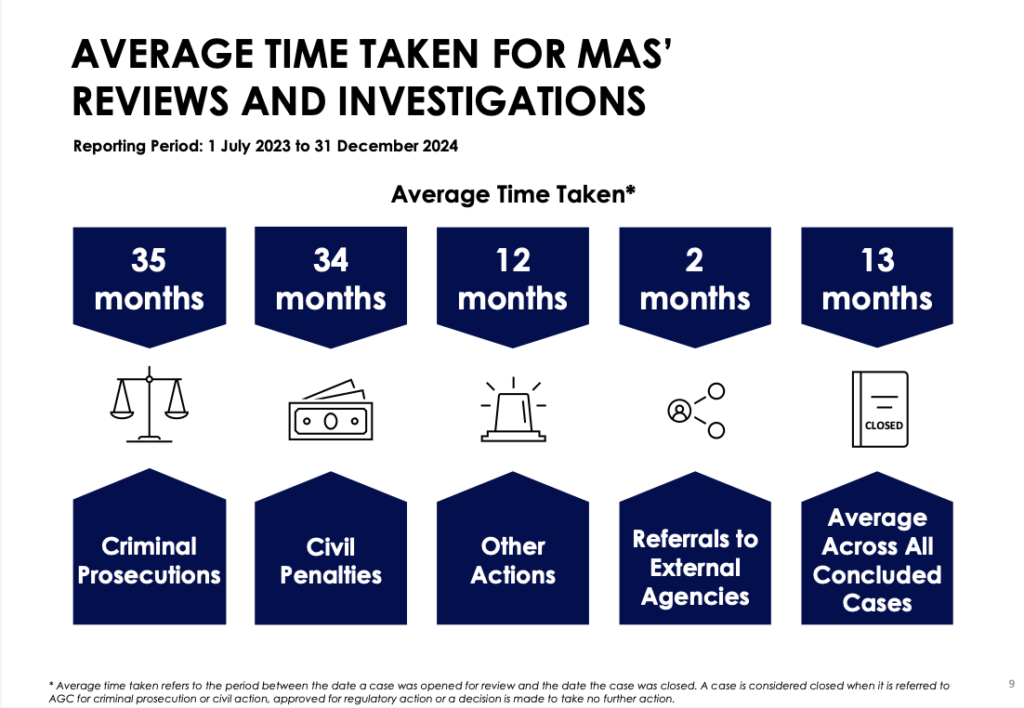

MAS’s recent enforcement activities leave no doubt about its priorities. The numbers speak volumes, showcasing a regulator sharpening its focus and its tools:

- Heavy Hitters: Over S$11.5 million in financial penalties and compositions were dished out, including S$4.4 million specifically targeting inadequate Anti-Money Laundering/Countering the Financing of Terrorism (AML/CFT) controls.

- Market Integrity Focus: S$7.16 million in civil penalties were imposed for market abuse, tackling false trading and deceptive practices head-on.

- Holding Individuals Accountable: Beyond corporate fines, MAS secured 33 criminal convictions jointly with the CAD and issued 22 Prohibition Orders, effectively barring unfit individuals from the industry.

- Upgraded Arsenal: New legislative amendments significantly boosted MAS’s ability to investigate misconduct and issue prohibition orders across a wider range of critical functions.

The consistent action against AML/CFT failures, particularly within fund management, underscores the absolute necessity of robust controls and vigilant senior management oversight.

AML Alert: Is Your Tech Ready for the AI Expectation?

The S$4.4 million penalty for AML/CFT lapses isn’t just a warning; it foreshadows a fundamental shift. MAS’s emphasis on “sharpened supervision” via data analytics, combined with global standards setters like FATF endorsing AI/ML for enhanced effectiveness, points to one conclusion: sophisticated technology is rapidly becoming the expected standard for AML/CFT compliance in Singapore. We predict this trend will solidify, potentially leading MAS to implicitly or explicitly expect AI-powered transaction monitoring systems from FIs within the next couple of years.

Why the urgency? Traditional, rule-based AML systems are increasingly outmatched by complex illicit financial networks. AI/ML offers the power to sift through massive datasets, uncover hidden patterns, perform sophisticated network analysis (a technique MAS employs), and drastically reduce the noise of false positives – capabilities that directly align with MAS’s push for greater effectiveness. Firms clinging to outdated methods risk not only operational inefficiency but also falling short of evolving regulatory standards, potentially attracting stricter scrutiny and penalties.

Watching the Watchers: How AI is Revolutionizing Market Surveillance

MAS is deploying advanced technology to police market integrity more effectively than ever before. The successful disruption of 33 market manipulation cases, linked strategically to augmented intelligence platforms like Project Apollo, marks a significant leap in surveillance capabilities. These aren’t just fancy algorithms; they represent a move towards real-time, predictive monitoring that can identify complex schemes like “pump and dump” operations far quicker than traditional methods.

Expect augmented intelligence to become the benchmark for market surveillance. MAS is likely to push for brokers and trading firms to integrate similar sophisticated tools, enhancing their ability to detect and disrupt manipulation in real-time. This technological arms race will extend deeply into digital asset markets, targeting specific abuses like wash trading, fueled by MAS’s expanded powers under the Payment Services Act. The era of purely reactive investigations is fading; predictive enforcement is the new frontier.

Crypto Crackdown Goes Global: MAS Strengthens Cross-Border Ties

Digital assets don’t respect borders, and neither does MAS’s enforcement approach. Recognizing the inherent cross-border risks, MAS is intensifying collaboration with international regulators and bodies like FATF and IOSCO. The significant number of Prohibition Orders against crypto intermediaries is just the beginning. The future involves weaving a tighter global net to combat illicit crypto activities. We anticipate:

- A Unified Front on the Travel Rule: MAS pushing for consistent FATF Travel Rule implementation across ASEAN, demanding better VASP data sharing.

- Targeted International Task Forces: More joint operations with global counterparts to dismantle offshore crypto fraud exploiting regulatory loopholes.

- Tech-Enabled Tracing: Increased exploration of shared blockchain analytics or regulated ledger access to pierce anonymity.

For any player in the digital asset space, robust cross-border compliance and data-sharing capabilities are rapidly becoming table stakes.

Stay Ahead of the Curve: Studio AM - Your Compliance Compass

MAS’s latest report confirms that navigating Singapore’s financial compliance landscape requires more than just keeping up – it demands looking ahead. The fusion of technology, stringent enforcement, and global cooperation creates a complex environment where proactive compliance is essential for success.

This is where Studio AM provides critical value. We specialize in understanding the intricate dynamics between finance, technology, and evolving regulations. The challenges highlighted by MAS – the need for AI-driven compliance, sophisticated surveillance, robust cross-border protocols, and unwavering governance – are precisely the areas where our expertise can make a difference. We offer strategic guidance and insight, helping FIs, fintechs, and regtechs build resilient, future-ready compliance programs that not only meet today’s standards but anticipate tomorrow’s. Partner with us to innovate confidently, secure in the knowledge that your compliance foundation is strong.

Is your compliance strategy ready for MAS’s tech-driven future? Connect with Studio AM to explore how our expertise can strengthen your approach.