Deconstructing the DNA of a Sustainable Stablecoin for the Post-Hype Era

The stability of the digital economy is built on a foundation of trust and clear rules.

In the financial sector, one principle stands the test of time: innovations that endure are built not on hype, but on a foundation of trust. In the dynamic world of digital assets, this principle is more critical than ever. Stablecoins, in particular, hold immense promise to revolutionize payments and finance, but their journey from a niche crypto-asset to a globally accepted financial tool depends entirely on this foundation.

The key to building that trust and unlocking their long-term, sustainable potential lies in robust regulatory frameworks. To understand why, we need only look at the market's two largest players, Tether (USDT) and USD Coin (USDC). Their diverging paths offer a powerful case study in how a commitment to compliance and transparency is becoming the ultimate competitive advantage.

A Tale of Two Stablecoins: The Market's Demand for Trust

While both USDT and USDC aim to maintain a 1:1 peg with the US dollar, their foundational strategies regarding transparency and regulatory alignment present a clear divide. The market's behavior shows a nuanced but important picture: while Tether (USDT) remains the largest stablecoin by market capitalization, USDC has carved out a crucial role as the preferred asset for institutions and platforms where regulatory compliance and transparent, audited reserves are paramount.

This distinction is not just theoretical; it drives real-world adoption. For example, USDC has been integrated by global payment leaders like Stripe and serves as a core settlement asset on regulated derivatives platforms. This adoption by mainstream financial players underscores a critical trend: for use cases that demand the highest level of trust—from corporate treasury to institutional trading—a stablecoin's commitment to compliance becomes its most valuable feature. This demand for trusted, transparent digital dollars is a powerful, long-term tailwind for assets like USDC.

Foundational Differences at a Glance

| Feature | USDC (USD Coin) | USDT (Tether) |

|---|---|---|

| Issuer | Circle, Coinbase | Tether Limited |

| Reserve Structure | Primarily held in cash and short-term U.S. government treasury bills. | A mix of assets, with a majority in cash & cash equivalents (including T-Bills), but also other assets. |

| Audit & Transparency | Monthly attestations by a top-tier accounting firm (Grant Thornton), with public reserve details. | Quarterly attestations from a non-Big Four firm; less granular public detail compared to USDC. |

| Regulatory Status | Proactively seeks regulatory licenses; issuer holds numerous state and international licenses. | Has faced past regulatory scrutiny and legal challenges regarding its reserve backing. |

| Primary Use Case | Institutional finance, DeFi, and regulated payment rails. | Dominant in overseas crypto-to-crypto trading markets. |

It's Not Just the Amount, It's the Quality of the Reserves

The core promise of a stablecoin is a 1:1 reserve ratio, but a crucial distinction must be made: simply having assets worth $1 for every token isn't enough. The critical question is: what kind of assets are they? This is where the definition of the reserve portfolio becomes the linchpin of the entire redemption mechanism.

If an issuer's reserves are held in illiquid corporate bonds or other volatile digital assets, they may not be able to sell those assets quickly enough—or at their stated value—to honor redemptions during a market panic. This is liquidity risk, and it is a primary threat to a stablecoin's peg.

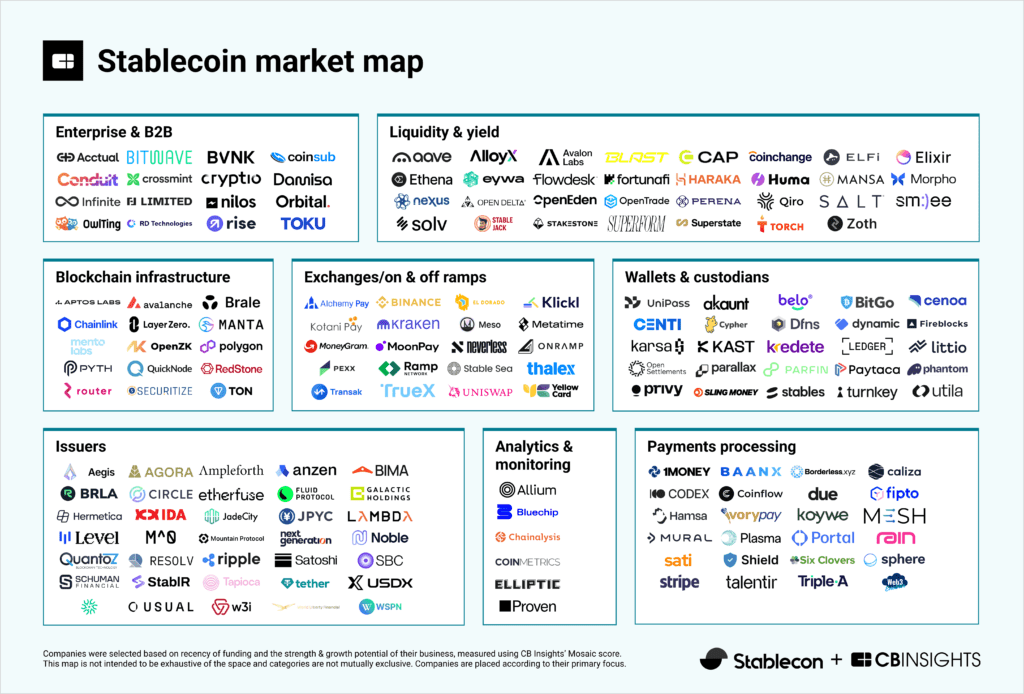

Stablecoin Market Map by CBINSIGHTS

This is why forward-thinking regulation, like Hong Kong's new Stablecoin Ordinance, explicitly defines the required nature of these assets.

"The reserve assets of a licensee must be of high quality and high liquidity with minimal investment risks."

- Hong Kong Stablecoin Ordinance, Schedule 2, Section 5(5)

This single sentence is incredibly powerful, as it legally prohibits issuers from backing their stablecoins with risky or hard-to-sell assets and directly links this requirement to ensuring that "valid redemption requests can be honoured without undue delay."

The Litmus Test of Trust: Immediate Redemption

A stablecoin's true value is tested when users want their money back. The quality and liquidity of the reserves, as mandated by regulation, are what make this possible. The Hong Kong Stablecoin Ordinance reinforces this by making redemption a guaranteed right.

"...on receiving a valid redemption request...honour the request as soon as practicable by paying the holder the par value of the specified stablecoin...in the reference asset to which the specified stablecoin is referenced."

- Hong Kong Stablecoin Ordinance, Schedule 2, Section 6(2)

This provision ensures that redemption is not a privilege but a core, enforceable obligation, built upon a foundation of prudently managed, high-quality reserves.

Why Compliance is the Engine for Sustainable Growth

Recent history has shown what happens when trust collapses. The catastrophic collapse of Terra's UST stablecoin and its sister token LUNA in 2022 serves as the ultimate cautionary tale. Unlike asset-backed stablecoins, UST was an algorithmic stablecoin, attempting to maintain its peg through a complex, automated arbitrage mechanism with LUNA. When market pressure mounted, this system entered a death spiral. The incident was not merely a market crash; it was a fundamental failure of design, proving that trust cannot be programmed into existence without tangible, transparent, and audited reserves. It underscored a critical lesson for the entire industry: without a verifiable 1:1 backing of high-quality assets, a stablecoin is built on a foundation of sand, vulnerable to a crisis of confidence that can wipe out billions in value overnight.

The 2022 LUNA/UST collapse highlighted the inherent risks of unbacked stablecoin models.

This is why the future of stablecoins depends entirely on a foundation of sound regulation. Institutions will not build critical infrastructure on assets with questionable reserves or opaque operating models.

This is where Hong Kong's new Stablecoin Ordinance shines. By focusing on the core pillars of stability—full reserve backing, high-quality liquid assets, guaranteed redemption rights, and transparent reporting—Hong Kong is not stifling innovation. It is creating the very conditions necessary for it to flourish sustainably. This clear regulatory framework provides certainty for issuers and protection for users, signaling to the world that Hong Kong is serious about fostering a safe, reliable, and world-class digital asset ecosystem. The stablecoins that thrive in this new era will be the ones that embrace regulation to earn and maintain the market's trust. Because trust is, after all, the most valuable asset of all.