DLT’s Defining Moment: How Financial Institutions Must Navigate the HKMA’s Roadmap for Adoption

DLT’s Defining Moment: How Financial Institutions Must Navigate the HKMA’s Roadmap for Adoption

Beyond Experimentation: Why Distributed Ledger Technology is Now a Regulatory and Operational Imperative

The Hong Kong Monetary Authority’s (HKMA) latest research on Distributed Ledger Technology (DLT) marks a turning point for financial institutions. While DLT has long been explored in proof-of-concept projects, the HKMA’s findings confirm a decisive shift: DLT is moving from the testing phase into live, institutional-grade financial infrastructure.

This shift is not just about innovation; it is about regulatory preparedness, operational efficiency, and long-term competitiveness. The emergence of tokenized deposits, DLT-based securities trading, and smart contract-driven compliance signals an industry-wide transformation. Institutions that do not adapt risk increased regulatory scrutiny, systemic inefficiencies, and competitive displacement.

This analysis breaks down the key takeaways from the HKMA’s report, identifies the challenges and opportunities of large-scale DLT adoption, and provides a strategic outlook for financial institutions preparing for this next phase of digital finance.

📖 Ref: HKMA (2025). Distributed Ledger Technology in the Financial Sector: A Study on the Opportunities and Challenges

https://www.hkma.gov.hk/media/eng/doc/key-information/guidelines-and-circular/2025/DLT_Research_Paper.pdf

DLT is No Longer a Niche Innovation—It is the Backbone of the Next-Generation Financial System

The HKMA’s report highlights a critical evolution: DLT is now being deployed in production environments across banking, securities, and payment systems. This is not speculation—it is happening now.

Financial institutions are integrating DLT into their core operations, with leading examples including:

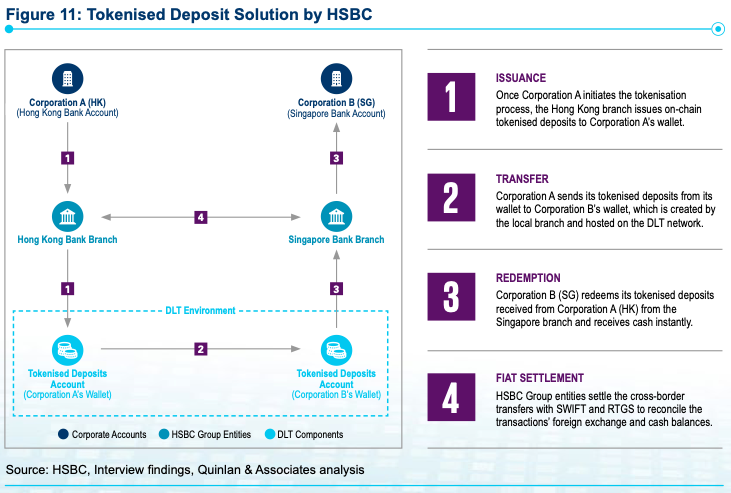

- HSBC’s Tokenized Deposits, enabling real-time cross-border fund transfers without reliance on traditional RTGS systems.

- UBS Tokenize, allowing for the issuance of natively digital securities, reducing inefficiencies in clearing and settlement.

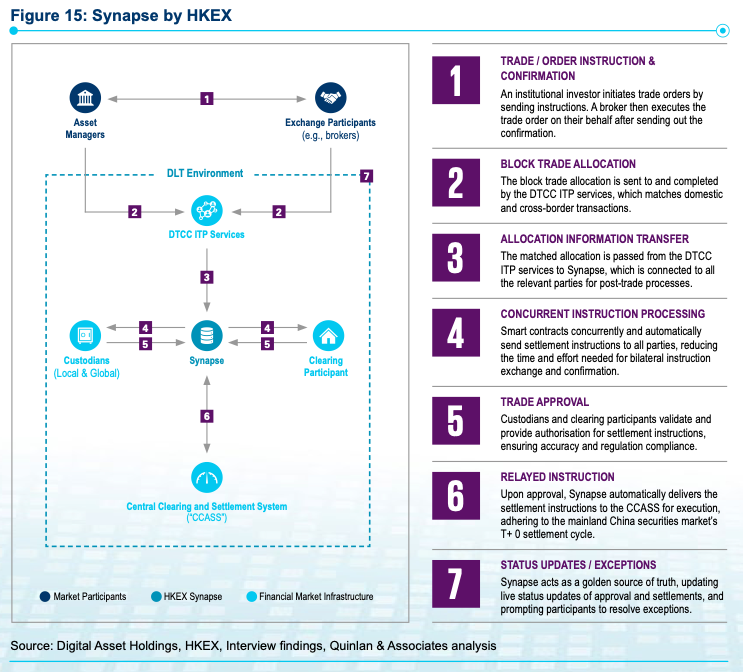

- HKEX Synapse, leveraging DLT to streamline Northbound Stock Connect settlements, mitigating counterparty risk and enhancing processing speed.

The transition from legacy infrastructure to DLT-based financial networks is accelerating due to three fundamental drivers:

- Regulatory Alignment – The HKMA’s Supervisory Incubator for DLT provides a structured testing environment, signaling that regulators are actively shaping DLT compliance frameworks, rather than passively observing market developments.

- Institutional Demand for Efficiency – Traditional financial processes, particularly in settlement and reconciliation, are costly and prone to delays. DLT’s ability to provide real-time, automated, and transparent transactions is now a competitive necessity.

- Market Infrastructure Evolution – The growth of tokenized assets, decentralized finance (DeFi) models, and programmable financial instruments is forcing financial institutions to adapt to a new paradigm of asset ownership and transferability.

Financial institutions that continue to rely on batch-based settlement, siloed ledgers, and manual reconciliation will encounter rising operational costs, slower market responsiveness, and increasing regulatory pressure to modernize. The shift to DLT is not optional—it is a strategic imperative.

Tokenization of Financial Assets: The Next Battleground for Regulatory and Market Leadership

A key theme in the HKMA’s research is the rapid institutional adoption of asset tokenization. This development extends far beyond cryptocurrencies and is now reshaping capital markets, trade finance, and structured financial products.

Institutional initiatives are already well underway:

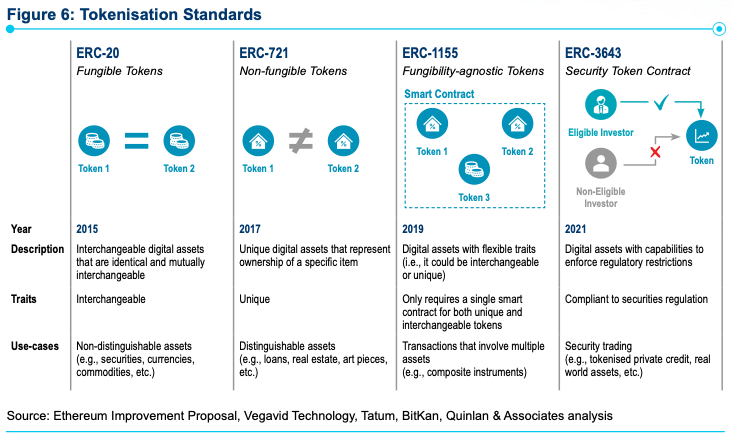

- The ERC-3643 Security Token Standard is enabling the creation of compliant, institutional-grade digital securities, integrating regulatory controls directly into tokenized assets.

- J.P. Morgan’s Kinexys Platform is replacing traditional repo transactions with tokenized collateralized lending, cutting settlement times from days to minutes.

- Decentralized oracles are bridging off-chain and on-chain data, allowing financial instruments to self-execute based on real-time market conditions, interest rate changes, and regulatory updates.

Despite these advancements, a regulatory and compliance framework for tokenized assets remains in development. The HKMA acknowledges key challenges that financial institutions must proactively address:

- Regulatory Classification of Tokenized Assets – How will tokenized deposits, digital securities, and stablecoins be categorized under existing financial regulations?

- AML/KYC Compliance for Tokenized Transactions – How can financial institutions implement real-time on-chain identity verification and risk assessment?

- Legal Enforceability of Smart Contracts – Can automated financial agreements fully comply with contractual laws, and how will dispute resolution be handled?

The HKMA’s Supervisory Incubator for DLT is expected to serve as a regulatory testbed for addressing these concerns. However, financial institutions must not wait for regulators to dictate the future—they must take an active role in shaping compliance-ready tokenization models.

Interoperability: The Industry’s Most Overlooked Risk

While the HKMA’s report outlines a strong case for DLT adoption, it also highlights a significant challenge that remains unresolved: interoperability between different DLT networks and legacy financial systems.

Currently, most financial institutions are implementing permissioned, private DLT networks, believing that greater control over validation and governance will provide security and regulatory compliance. However, this has led to fragmented ecosystems that do not seamlessly interact.

The risks of a fragmented DLT landscape include:

- Liquidity Barriers – If tokenized assets cannot move across different networks, financial institutions will experience capital inefficiencies, fractured liquidity pools, and operational bottlenecks.

- Regulatory Complexity – Without a standardized approach to cross-chain compliance and transaction monitoring, institutions will struggle to meet regulatory obligations across jurisdictions.

- Security Weaknesses – Private DLT networks often rely on a limited number of validators, creating single points of failure that could compromise network integrity.

Solving these challenges requires industry-wide collaboration on:

- Cross-Chain Interoperability Protocols that allow tokenized assets to move seamlessly between different DLT networks and traditional financial systems.

- Regulatory Harmonization Efforts to ensure that compliance frameworks can be applied consistently across multiple blockchain ecosystems.

- DLT Risk Management Strategies that address smart contract vulnerabilities, transaction reversibility, and systemic risk mitigation.

The institutions that take the lead in developing and implementing interoperability solutions will define the next phase of DLT adoption and secure a competitive advantage.

Compliance and Risk Management: Why Regtech Must Rapidly Evolve

The HKMA’s report underscores a critical industry gap—traditional compliance models are misaligned with DLT-based financial systems.

As financial institutions transition toward real-time, automated, and decentralized financial transactions, compliance frameworks must also evolve beyond manual reporting and periodic audits. The future of regulatory oversight will be centered on:

- On-Chain AML/KYC Enforcement – Identity verification and risk assessment will become embedded within blockchain transactions, rather than conducted post-transaction.

- Automated Smart Contract Auditing – Compliance teams will need to deploy AI-powered verification toolsthat ensure financial agreements comply with evolving regulations before execution.

- AI-Driven Regulatory Adaptation – Machine learning models will dynamically adjust risk scoring, compliance thresholds, and regulatory reporting requirements in real time.

The HKMA and the Securities and Futures Commission (SFC) are signaling a move toward automated, blockchain-native compliance solutions. Financial institutions that fail to integrate these technologies will face heightened regulatory scrutiny and operational inefficiencies.

Strategic Outlook: The HKMA is Defining the Future—Are You Ready to Lead or Forced to Follow?

Strategic Outlook: The HKMA is Defining the Future—Are You Ready to Lead or Forced to Follow?

The HKMA’s findings are not speculative—they outline a clear trajectory for the financial sector’s evolution. DLT is no longer an optional innovation; it is the foundation of the next generation of financial infrastructure.

Financial institutions must act decisively by:

- Deploying tokenized financial products that align with emerging regulatory models.

- Developing interoperability solutions to prevent market fragmentation.

- Upgrading compliance frameworks to match the speed and complexity of DLT-driven finance.

At Studio AM, we specialize in helping financial institutions navigate this transformation, ensuring that DLT adoption aligns with regulatory compliance and operational efficiency.

📩 Contact us to discuss your institution’s DLT strategy. The financial landscape is shifting—now is the time to lead.